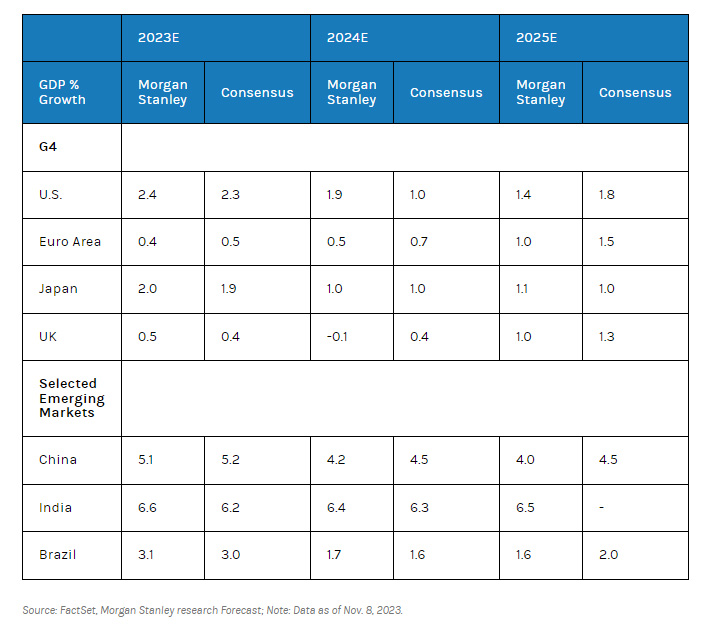

Morgan Stanley Research expects slowing global growth as central banks walk a fine line between inflation and recession.

With inflation cooling, central banks around the world face a Goldilocks dilemma: If they are too easy with monetary policy, inflation could come roaring back; but if they keep policy too tight, it could trigger a recession.

As central bankers try to maneuver a “soft landing,” Morgan Stanley economists expect their efforts will come with a tradeoff: lackluster growth in 2024 and 2025, especially in developed markets.

“Inflation has peaked globally, but getting through the last stretch won’t happen until 2025 and will likely require a period of subpar growth,” says Seth Carpenter, Global Chief Economist at Morgan Stanley.

Our economists predict that global economic expansion will tick down to 2.8% in 2024 and 2.9% in 2025, from 3% in 2023.

Getting Back to Target

In 2023, central banks successfully tamped down price gains by ratcheting up interest rates, slowing the pace of inflation to mid-to-low single digits. Heading into 2024, inflation should continue to fall in developed markets, while emerging markets may see a more gradual letup due to the volatility of food and energy prices.

“The decline of inflation in 2024 should be much more gradual than in 2023, as inflation is close to—but not quite at—target in most developed market economies,” Carpenter says.

A Mixed Growth Outlook

Overall, our economists expect growth in developed markets to remain broadly soft with a mixed picture in emerging market growth. Here’s a closer look at Morgan Stanley’s outlook for growth across regions:

- In the U.S., growth should slow to 1.9% year over year in 2024 and 1.4% in 2025, down from an estimated 2.4% in 2023, as higher interest rates and tighter monetary policy work their way through the financial system. Economists also expect U.S. consumer spending to begin to slow more meaningfully in 2024 and 2025, driven by a cooling labor market, which weighs on real disposable income, and elevated rates putting further pressure on debt service costs. Among bright spots: business investment should finally turn positive in the second half of 2024 after two years of decline.

- The Euro Area could eke out a gain of 0.5% in 2024, reflecting the ongoing effects of energy supply shocks, especially in Germany. Growth should accelerate to 1% in 2025, driven by inflation declines and a resilient job market, which may lift inflation-adjusted incomes and consumer spending.

- The UK is likely to experience a near-term drag following healthcare and transport strikes. The economy could dip into a technical recession at the beginning of 2024, with a 0.5% gain by the end of the year, picking up to 1% in 2025.

- Emerging markets present a mixed picture, with expansion in India, Indonesia and the Philippines counterbalanced by tepid growth in China, which has disappointed on post-COVID reopening recovery and growth expectations. Our economists see a bumpy path back to stable growth but expect the government to respond with policies to stimulate the economy.

- For Japan, significant nominal growth is expected (5.4% in 2023) amid the economy’s great escape from the lost decades. However, wage growth and strong domestic inflation should keep nominal GDP growth at 3.6% in 2024. Real GDP growth (after factoring in inflation) should be 1% in 2024, and 1.1% in 2025.

- In Central Europe, the Middle East and Africa, Poland should start to recover, with 3.4% growth in 2024, up from 0.7% this year. Growth will pick up in Hungary and the Czech Republic, while Turkey will see a slowdown. In Israel, the impact of the conflict in Gaza should be contained to the fourth quarter of 2023, followed by a swift recovery in the first three months of 2024.

- In Latin America, Morgan Stanley forecasts muted growth in Brazil, with real GDP growth of 1.7% in 2024 and 1.6% in 2025, down from an estimated 3.1% in 2023. Growth in Mexico is likely to be 2.3% in 2024 and 2.2% in 2025, down from an estimated 3.4% in 2023, as strong labor markets and remittances boost consumption, and near-shoring continues to bolster the economy. Chile’s economy will rebound, Colombia will see a slowdown and the recession in Argentina will likely deepen.

What’s Next for Monetary Policy

Central banks in developed markets have signaled that they will maintain higher interest rates until they are convinced that inflation has reached desired levels. So far, strong labor markets have allowed policymakers to raise rates without triggering an alarming increase in joblessness.

If inflation continues its downward trajectory, Morgan Stanley expects central banks in the U.S. and Europe to begin cutting rates in mid-2024. Once U.S. inflation normalizes, it will help pave the way for rate cuts across Latin America. Japan, which has maintained a zero-interest rate policy, is likely to remove some policy controls in early 2024, with a possible rate hike in July 2024. China is likely to continue to hold rates low as it contends with subdued inflation.

But central banks may change course, maintaining higher rates if inflation resurges or cutting more quickly if growth stalls and unemployment spikes. In particular, an acceleration in U.S. growth could indicate that the Fed undershot and may need to raise rates further to rein in inflation. This could also increase the risks around the world, pinning central banks between growth and inflation.

“While recessions remain a risk everywhere, we expect any recession in our baseline scenario — such as in the UK — to be shallow because inflation is falling with full employment,” Carpenter says.