While conflicts in the Middle East or more persistent price increases could still knock the economy from its more stable footing, the Paris-based organization said risks are becoming “better balanced.”

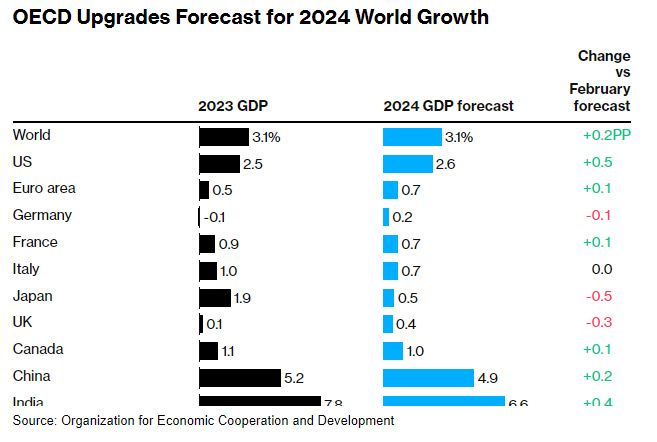

The OECD raised the 2024 global growth forecast to 3.1% — from 2.9% in February — with notable improvements in its expectations for the US, China and India. The expansion should continue at 3.2% next year.

On Wednesday in Washington, Federal Reserve Chair Jerome Powell kept hopes alive for a rate cut in 2024 while acknowledging that a burst of inflation has reduced policymakers’ confidence that price pressures are ebbing.

“Cautious optimism has begun to take hold in the global economy, despite modest growth and the persistent shadow of geopolitical risks,” OECD Chief Economist Clare Lombardelli said. “Inflation is easing faster than expected, labor markets remain strong with unemployment at or near record lows.”

In the recovery, the OECD said divergence between strong growth in the US and a more sluggish Europe will persist in the near term, creating a “mixed macroeconomic landscape.” That will translate into differing paces of interest rate cuts, with the European Central Bank set to begin easing before the Fed.

Still, the OECD said monetary authorities should be cautious because conflicts could push up energy prices and inflation, and the softening of cost pressures may also be slower than expected in services.

OECD Inflation Forecast for 2024

For governments, it said the improving economic backdrop provides the opportunity to tackle bloated debt burdens that risk swelling further as higher borrowing costs feed through. It also cautioned countries will face growing spending demands from aging populations, climate change and needs to bolster defense.