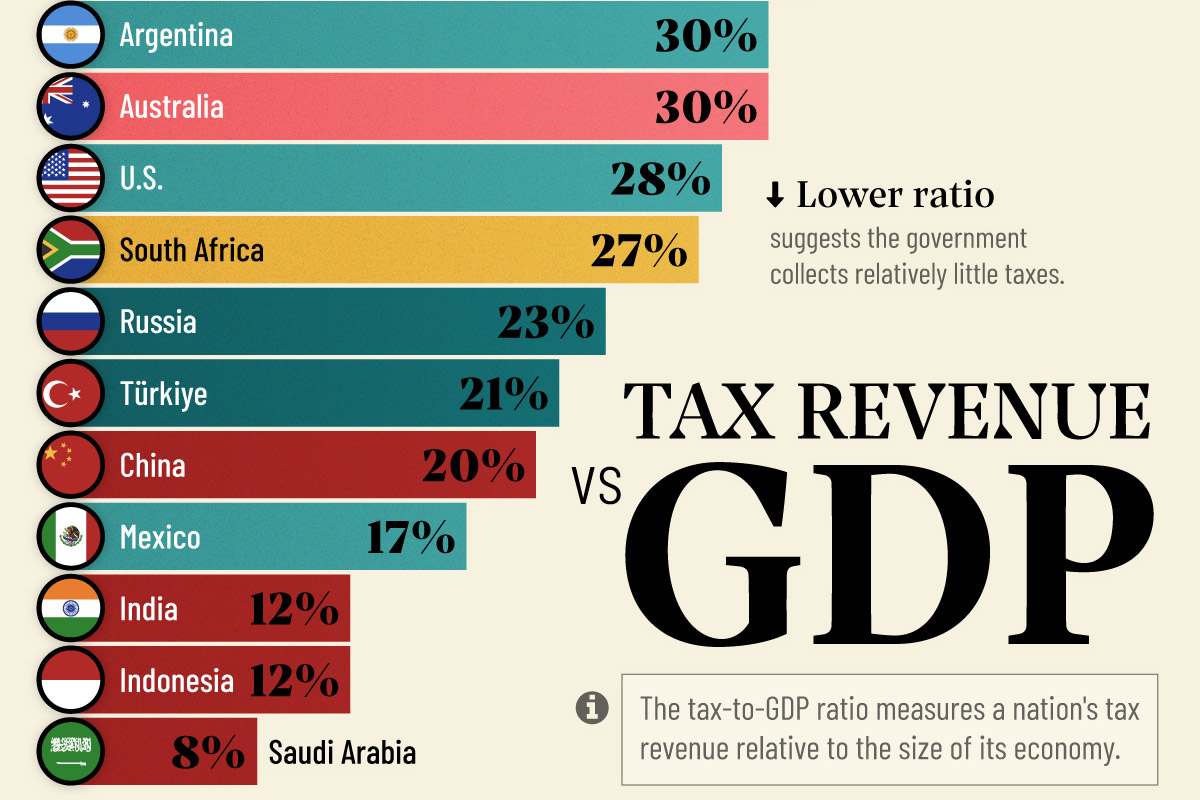

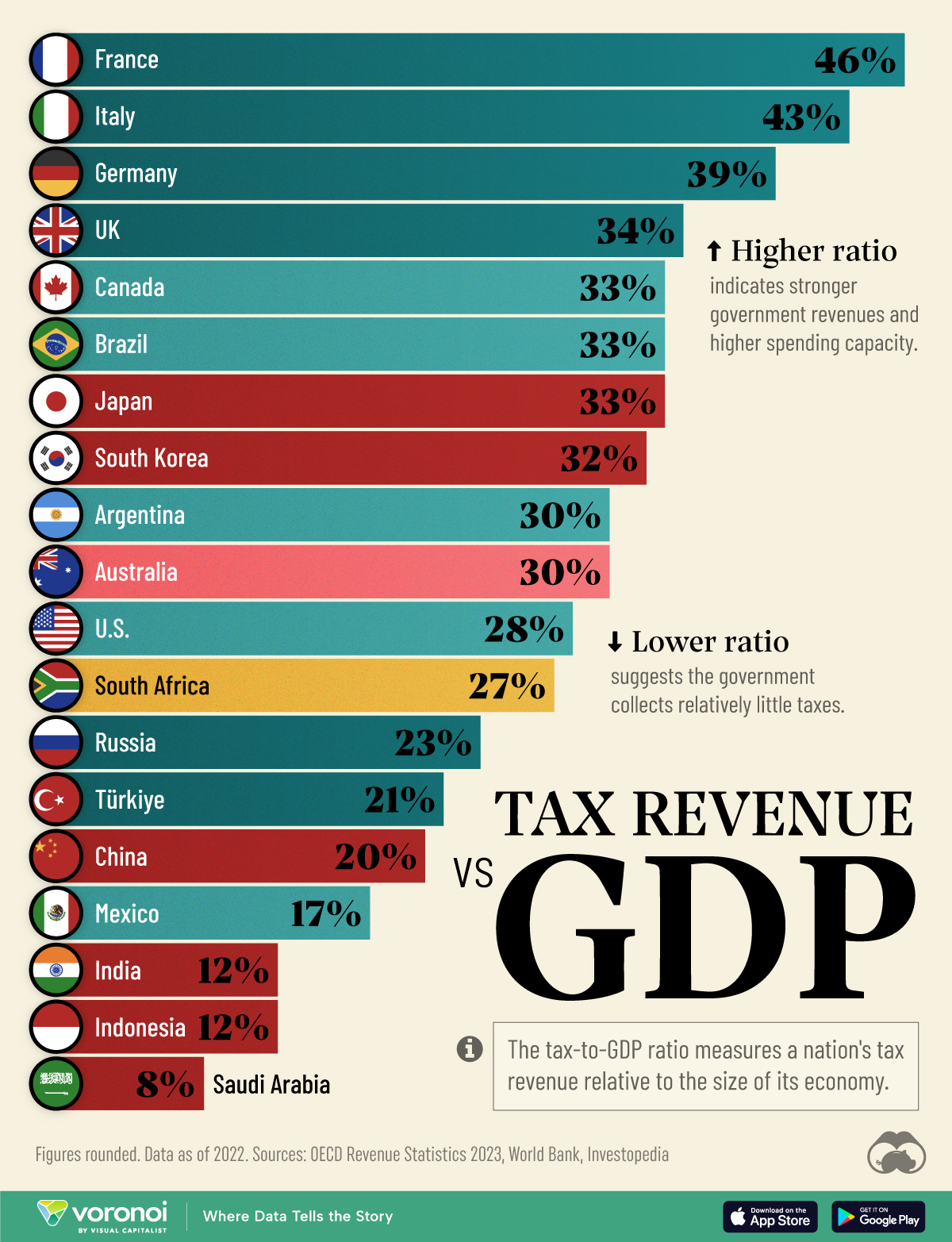

Charted: Tax Revenue vs. GDP for Major Countries

In this visualization, we rank the world’s major economies by their tax-to-GDP ratios, as sourced from OECD Revenue Statistics 2023.

The tax-to-GDP ratio measures a country’s tax revenue relative to the size of its economy.

Why does it matter?

A higher ratio may indicate higher taxes and more government revenue coming in compared to economic output. Meanwhile, a lower level reflects a lighter tax burden relative to the size of the economy.

EU Countries Understand Tax Collection

European countries have some of the highest tax revenues, relative to their economies, in the world.

Amongst the G20 economies, the top three by tax-to-GDP ratio all belong to the European Union, and the fourth (the UK) only left the collective in 2020.

| Rank | G20 Member | Region | Tax-to-GDP Ratio |

|---|---|---|---|

| 1 | 🇫🇷 France | Europe | 46% |

| 2 | 🇮🇹 Italy | Europe | 43% |

| 3 | 🇩🇪 Germany | Europe | 39% |

| 4 | 🇬🇧 UK | Europe | 34% |

| 5 | 🇨🇦 Canada | Americas | 33% |

| 6 | 🇧🇷 Brazil | Americas | 33% |

| 7 | 🇯🇵 Japan | Asia | 33% |

| 8 | 🇰🇷 South Korea | Asia | 32% |

| 9 | 🇦🇷 Argentina | Americas | 30% |

| 10 | 🇦🇺 Australia | Oceania | 30% |

| 11 | 🇺🇸 U.S. | Americas | 28% |

| 12 | 🇿🇦 South Africa | Africa | 27% |

| 13 | 🇷🇺 Russia | Europe | 23% |

| 14 | 🇹🇷 Türkiye | Europe | 21% |

| 15 | 🇨🇳 China | Asia | 20% |

| 16 | 🇲🇽 Mexico | Americas | 17% |

| 17 | 🇮🇳 India | Asia | 12% |

| 18 | 🇮🇩 Indonesia | Asia | 12% |

| 19 | 🇸🇦 Saudi Arabia | Asia | 8% |

| N/A | 🌐 World | World | 15% |

Note: Figures rounded. Data as of 2022, sourced from OECD Revenue Statistics 2023. The EU is also a G20 member but is not included for this visualization.

However, regional trends don’t hold up past that. On the other hand, economic trends are more noticeable. For example, eight of the top 10 in the ranking are high income countries per World Bank classifications.

And in contrast, the only two lower-middle income countries in the G20, India and Indonesia, are in the bottom three.

The World Bank says a 15% ratio is critical for economic growth and poverty reduction. A 10-year study estimated that the per capita GDP for countries that hit the 15% threshold would be 7.5% larger than if they had not.

China is one of the best examples for this phenomenon where tax revenues rose before the country’s significant per capita GDP growth in the 2000s.

Of course, there are exceptions to this. Saudi Arabia, and other wealthy oil exporters (UAE, Kuwait, Brunei) have lower ratios simply because they do not need to fund government expenditure through taxation.

Información extraída de:https://www.visualcapitalist.com/charted-tax-revenue-vs-gdp-for-major-countries/