Charted: Home and Rent Price Changes in Global Cities (2015-2025)

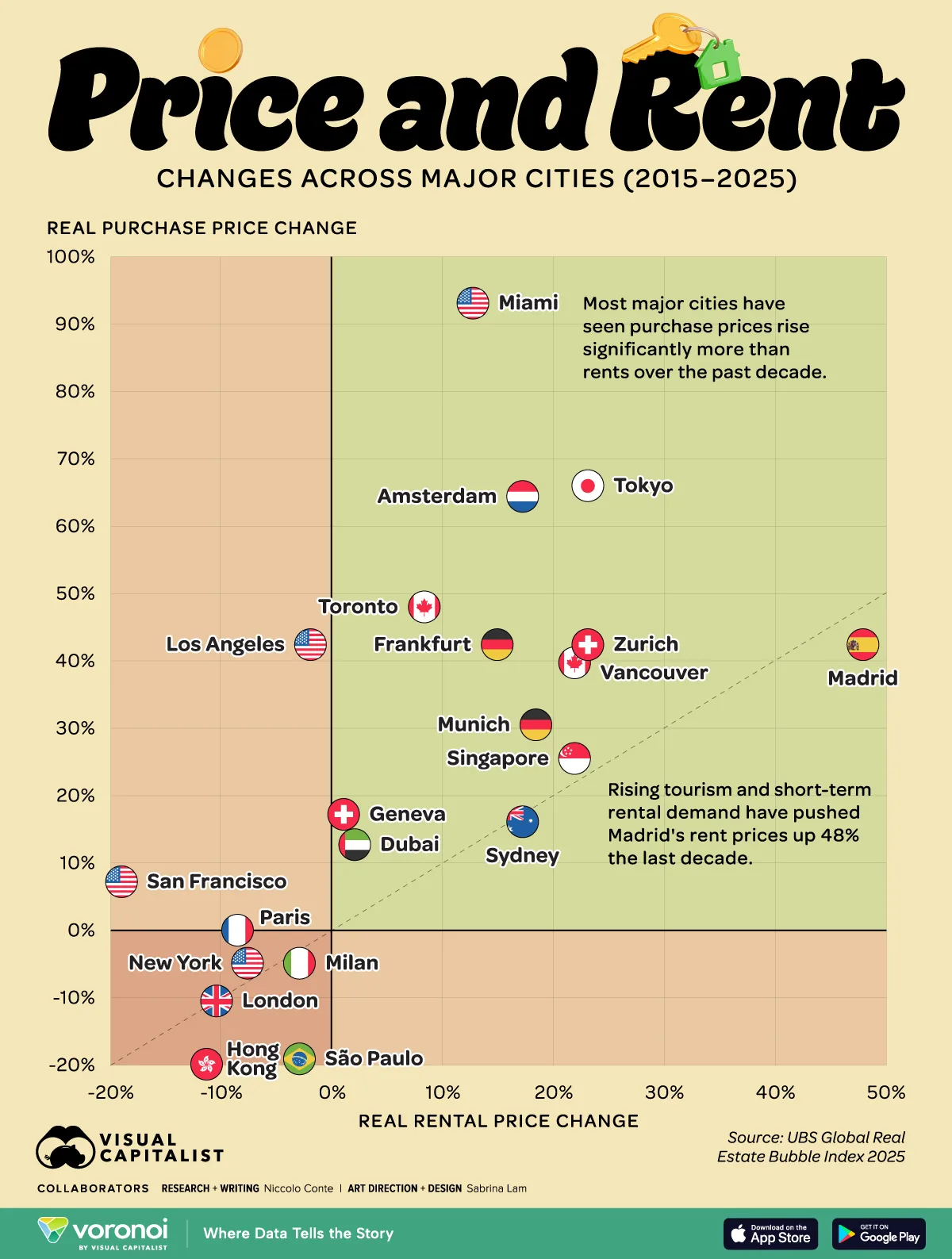

From 2015 to 2025, global real estate markets experienced significant divergence between real home price growth and rent price growth.

While most major cities saw home values rise faster than rents, a few key markets—particularly in Europe and Asia—showed softening property prices amid slowing demand and tighter credit conditions.

This visualization highlights 25 major global cities from the UBS Global Real Estate Bubble Index 2025, comparing inflation-adjusted percentage changes in both home and rental prices over the past decade

Miami Leads Global Home Price Growth Since 2015

Miami topped the list with a staggering 93.1% increase in real home prices, showing the strongest decade-long appreciation globally.

Despite this, rent prices grew only 12.7%, reflecting a widening affordability gap.

The data table below shows the real home price change and real rent price change across 25 major cities around the world.

|

City

|

Real home price change (2015-2025)

|

Real rental price change (2015-2025)

|

|---|---|---|

| 🇺🇸 Miami, United States | 93.1% | 12.7% |

| 🇯🇵 Tokyo, Japan | 66.0% | 23.1% |

| 🇳🇱 Amsterdam, Netherlands | 64.4% | 17.2% |

| 🇨🇦 Toronto, Canada | 48.0% | 8.3% |

| 🇪🇸 Madrid, Spain | 42.4% | 48.0% |

| 🇨🇭 Zurich, Switzerland | 42.4% | 23.1% |

| 🇩🇪 Frankfurt, Germany | 42.4% | 14.9% |

| 🇺🇸 Los Angeles, United States | 42.4% | -2.0% |

| 🇨🇦 Vancouver, Canada | 39.7% | 21.9% |

| 🇩🇪 Munich, Germany | 30.5% | 18.4% |

Similar trends occurred in other North American cities: Toronto’s home prices rose 48%, while rents climbed a modest 8.3%, and Vancouver saw a 39.7% jump in property values compared to 21.9% rent growth.

These disparities underscore how ownership demand in North America—fueled by migration, investment, and limited supply—has far outpaced rental market fundamentals.

New York City was an outlier, with declines in both home and rent prices of 4.9% and 7.7% respectively.

Europe’s Home and Rent Price Changes Vary

Europe’s housing performance was varied, with Madrid being an outlier with significant increases especially in rent prices.

Madrid saw home prices rise by 42.4%, while rents surged 48%, the steepest rental increase among all major global cities. This reflects Spain’s booming short-term rental sector and tourism rebound.

In contrast, London’s property and rent prices have fallen 10.5% since 2015, potentially reflecting Brexit’s lingering effects and the significant millionaire exodus the country faces.

Milan was another city which saw declines in both metrics, with a 4.9% and 3% fall in property and rental prices.

Meanwhile, Zurich and Munich both saw double-digit home price increases of 42.4% and 30.5%, with rent gains also in the double digits at 23.1% and 18.4%, respectively.

Información extraída de: https://www.visualcapitalist.com/charted-home-and-rent-price-changes-in-global-cities-2015-2025/