Nothing much to see here, so move along please. That has been the message from the White House to those who fear the collapse of three US banks in as many months spells serious trouble for the world’s biggest economy.

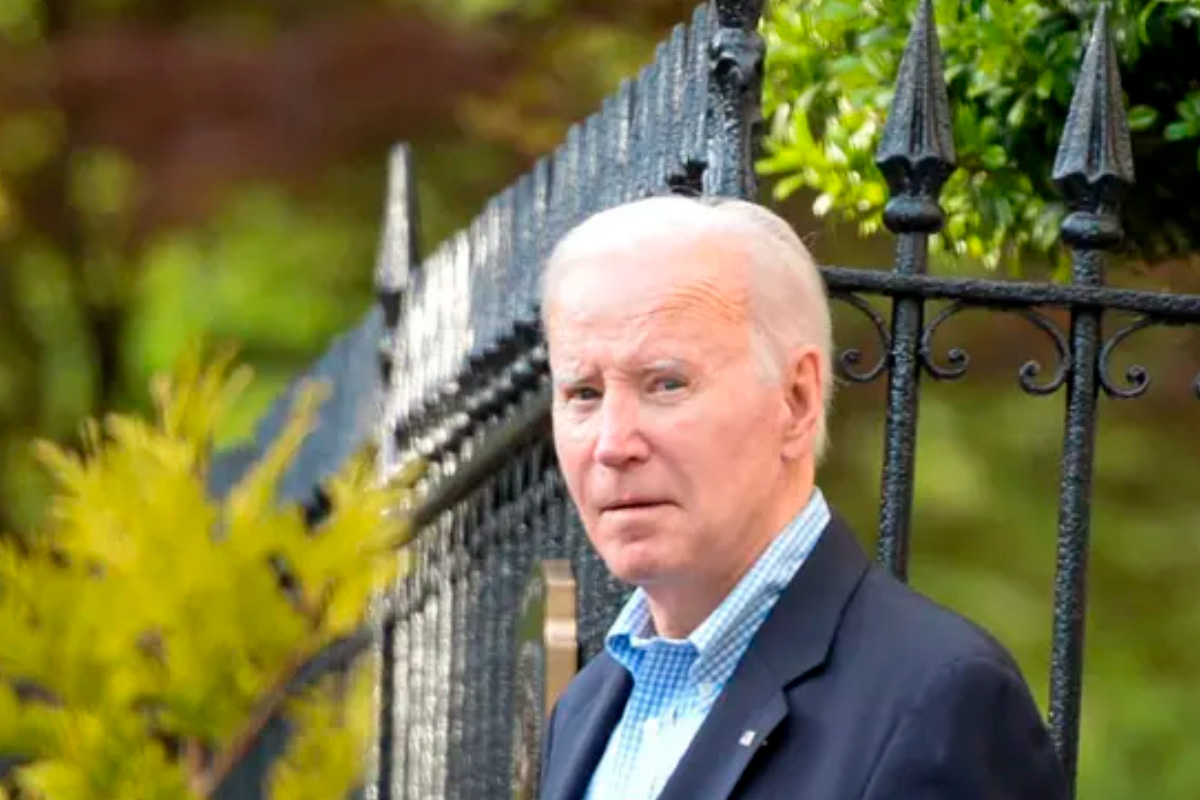

Joe Biden has a point, even though the line that the US financial system is fundamentally sound has become harder to maintain as it becomes clear that Silicon Valley Bank was not a one-off. The American economy has slowed down but continues to grow. Jobs are still being created. The unemployment rate is low at 3.4%. Manufacturing firms are heading to the US to take advantage of the green subsidies contained in Biden’s Inflation Reduction Act.

The spin is that none of what has happened thus far – least of all the collapse of a small number of regional US banks – should come as a surprise. Indeed, what’s surprising is how well the US economy is holding up. The US will emerge relatively unscathed as it invariably does. What is there to be worried about?

Plenty, as it happens. The US has just witnessed one of the biggest bubbles of the past 100 years. That has been followed by the most rapid increase in interest rates for four decades, which has taken official borrowing costs from near zero to more than 5% in little more than a year. If Biden is not worried about the implications of this for his re-election prospects in November 2024, then he should be. Things could turn nasty very quickly, for the economy and for the president personally.

In the circumstances, it will be little short of miraculous if the Federal Reserve – the US central bank – manages to finesse a soft landing for the economy. Wall Street is expecting interest rates to start coming down in July and to be just over 4% by the end of 2023 but the markets are getting ahead of themselves. Jobs growth is slowing but that won’t be enough on its own to persuade the Fed to start cutting rates. For that to happen, a lot more banks would need to start going bust.

That’s entirely possible. The longer rates stay high the tougher life gets for vulnerable banks. Those institutions in better financial shape will limit the flow of new credit to firms and individuals. Inflation will be squeezed out of the economy but at a heavy cost. The Fed will eventually cut interest rates aggressively but by then it will be too late to avoid a hard landing.

To a large extent, it will be a recession of the central bank’s own making. At the tail end of 2021, asset prices were booming across the board in the US. Shares, residential property, bonds, cryptocurrencies: all were part of a buying mania. With some justification, it was dubbed the “everything bubble”.

For students of economic history, there were distinct similarities between the frenzy as the American economy emerged from the Covid pandemic and previous bubbles: the buildup to the Wall Street crash of 1929, the Japanese equity and property boom of the late 1980s; the dotcom implosion of 2000 and the global financial crisis of 2008.

There was one key difference, however. The four previous bubbles had all come at the peak of business cycles, when the strength of the underlying economy provided some justification for the optimism in the financial markets. The “everything” bubble was not like that. Asset prices – lubricated by vast amounts of cheap money from the Fed – boomed but the real economy did not.

So, predictably enough, asset prices were the first to suffer when the Fed began to tighten policy early last year. Phase one of the unwinding of the bubble involved house, bond and share prices all suffering during 2022. In phase two, attention has switched to banks caught out by the unexpectedly rapid rise in interest rates. Phase three, which has only just begun, is when the real economy will really start to hurt. By the time unemployment starts rising, the recession will already be under way. Some economists think it already has.

The pricking of two of America’s previous mega bubbles – in 1929 and 2008 – had long-lasting and far-reaching consequences. It took the military spending of the second world war to end the Great Depression, while the impact of the 2008 crash is still being felt 15 years later.

The fallout from the other two bubbles – Japan in 1989 and the ending of the mania for internet stocks – was not so serious but still painful. Japan suffered a lost decade in the 1990s and the US economy suffered a brief recession after the dotcom collapse.

Even if this is not the equivalent of 1929 or 2008 (and the signs so far are that isn’t), Biden could still be in political trouble. It would be unusual for a bubble as big as that which peaked in late 2021 to be deflated without more collateral damage than there has been seen so far.

Only three sitting US presidents who have sought re-election since the second world war after serving a full first term have failed to win a second: Donald Trump in 2020, George Bush senior in 1992 and Jimmy Carter in 1980. All three faced an uphill battle because of a struggling economy. In Carter’s case, there was a double-dip recession after the Fed – under the legendary inflation hawk Paul Volcker – raised interest rates, cut them before inflation was fully under control, then raised them again. The Fed will no doubt want to avoid a repeat performance, and since its chair, Jerome Powell, has admitted he knows of no way to bring inflation down painlessly, it is a question of how hard the recession will be and how soon it will be over.

… as 2023 gathers pace, and you’re joining us from Colombia, we have a small favour to ask. We are living through turbulent times, but the Guardian is always there, providing clarity and fearless, independent reporting from around the world, 24/7.

We know not everyone is in a position to pay for news. But as we’re reader-funded, we rely on the ongoing generosity of those who can afford it. This vital support means millions can continue to read reliable reporting on the events shaping our world. Will you invest in the Guardian this year?

Unlike many others, we have no billionaire owner, meaning we can fearlessly chase the truth and report it with integrity. 2023 will be no different; we will work with trademark determination and passion to bring you journalism that’s always free from commercial or political interference. No one edits our editor or diverts our attention from what’s most important.

With your support, we’ll continue to keep Guardian journalism open and free for everyone to read. When access to information is made equal, greater numbers of people can understand global events and their impact on people and communities. Together, we can demand better from the powerful and fight for democracy.

Help power the Guardian’s reporting for the years to come, whether with a small sum or a larger one. If you can, please support us on a monthly basis from just $2. It takes less than a minute to set up, and you can rest assured that you’re making a big impact every single month in support of open, independent journalism. Thank you.