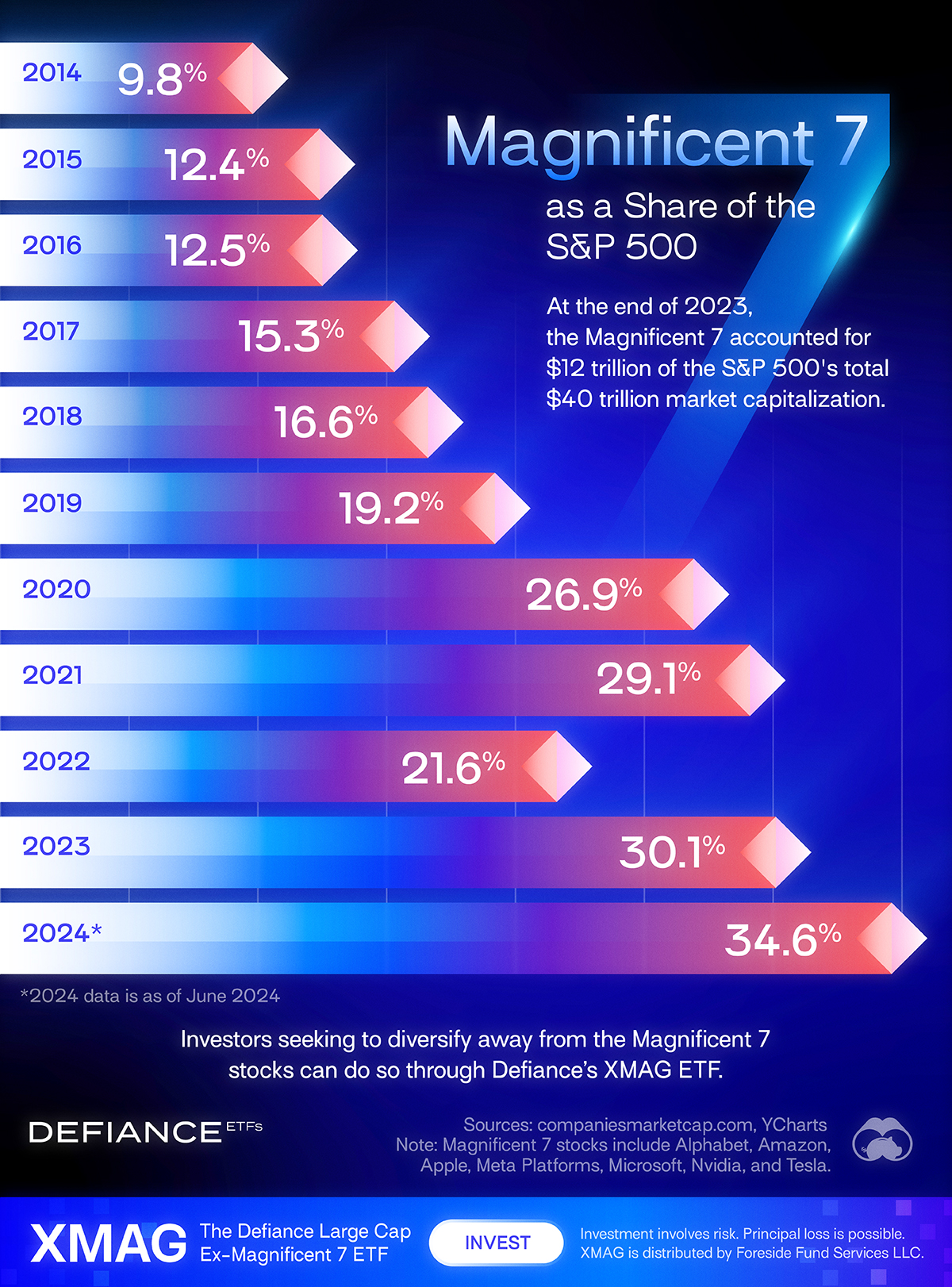

Charted: Magnificent 7 Market Cap as a Share of the S&P 500

In mid-2024, the Magnificent 7 accounted for nearly $16 trillion of the S&P 500’s total $46 trillion market capitalization.

This graphic, created in partnership with Defiance ETFs, provides visual context to the trend of increasing concentration in the U.S. large-cap benchmark around these seven stocks.

The Rise of the Tech Giants

The Magnificent 7 stocks—Alphabet (Google), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla—are influential companies that have contributed to relatively large gains to the index in recent years.

Over the last decade, the market capitalization of the seven stocks has grown by nearly 800%. This compares to 150% for the broader benchmark. The largest gainers of the group have been Nvidia, Tesla, and Amazon.

Furthermore, while these stocks have shown relatively strong performance, concentrating investments in just a few can heighten concentration risk. Many investors may not realize the S&P 500 could be exposing them to this factor.

The Magnificent 7 & the S&P 500

The S&P 500 is the main benchmark for U.S. large cap stocks. It includes just over 500 major, publicly-traded firms.

| Year | Mag 7 Share of S&P 500 Market Cap |

|---|---|

| 2024 | 34.6% |

| 2023 | 30.1% |

| 2022 | 21.6% |

| 2021 | 29.1% |

| 2020 | 26.9% |

| 2019 | 19.2% |

| 2018 | 16.6% |

| 2017 | 15.3% |

| 2016 | 12.5% |

| 2015 | 12.4% |

| 2014 | 9.8% |

Despite the S&P 500 consisting of 500 companies, these seven stocks have recently come to represent more than one-third of the index. In 2014, the market cap of these tech giants stood at just under 10%. By mid-2024, that figure was nearly 35%.

Unknown Concentration Risk

The index’s high exposure to these seven stocks could present a problem to investors. Additionally, the Magnificent 7 are heavily concentrated in a single industry—tech.

By investing in a broad U.S. large-cap index that excludes these stocks, investors can mitigate or avoid this concentration risk. Defiance’s XMAG—an ex-Magnificent 7 U.S. large-cap ETF—provides a potential solution for those seeking greater diversification.

XMAG is the first ETF offering exposure to the S&P 500 excluding the “Magnificent 7” tech giants.

About the fund: XMAG offers a unique opportunity for investors to access the broader market while reducing concentration risk in these dominant tech stocks.

About the index: the BITA US 500 ex Magnificent 7 Index aims to provide a comprehensive and balanced representation of the U.S. equity market by including the largest 500 publicly traded securities, while specifically excluding the seven largest technology giants commonly referred to as the “Magnificent 7.” The index constituents are weighted based on free-float market capitalization and rebalanced quarterly. Index values are disseminated on an end-of-day basis.

Important Disclosures

The Fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The prospectus and summary prospectus contain this and other important information about the investment company. Please read the prospectus and / or summary prospectus carefully before investing. Hard copies can be requested by calling 833.333.9383.

Investing involves risk. Principal loss is possible.

As an ETF, the funds may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. A portfolio concentrated in a single industry or country, may be subject to a higher degree of risk.

Tracking Error Risk. As with all index funds, the performance of the Fund and the Index may differ from each other for a variety of reasons.

Large-Capitalization Investing. The securities of large-capitalization companies may be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. Large-capitalization companies may also be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes.

Passive Investment Risk. The Fund is not actively managed and does not attempt to outperform the Index or take defensive positions in declining markets. As a result, the Fund’s performance may be adversely affected by a general decline in the market segments relating to the Index.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

Información extraída de: hhttps://www.visualcapitalist.com/sp/charted-magnificent-7-market-cap-as-a-share-of-the-sp-500/