China’s exports fell last month at their fastest pace since the onset three years ago of the COVID-19 pandemic, as an ailing global economy puts mounting pressure on Chinese policymakers for fresh stimulus measures.

Momentum in China’s post-COVID recovery has slowed after a brisk pickup in the first quarter, with analysts now downgrading their projections for the economy for the rest of the year.

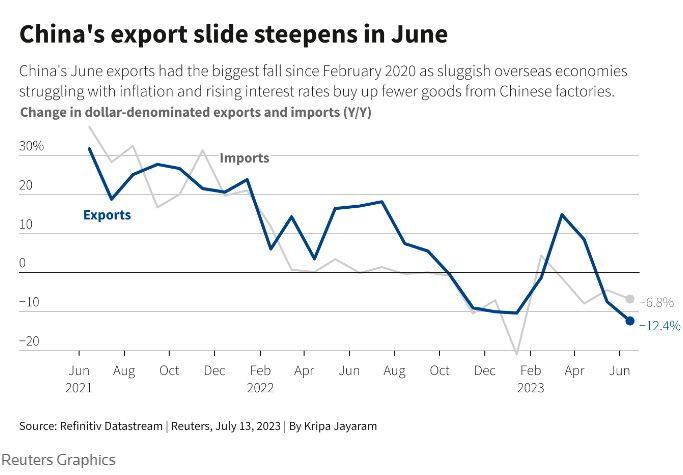

Outbound shipments from the world’s second-largest economy slumped a worse-than-expected 12.4% year-on-year in June, data from China’s Customs Bureau showed on Thursday, following a drop of 7.5% in May.

Imports contracted 6.8%, steeper than an expected 4.0% decline and the previous month’s 4.5% fall.

“The global downturn in goods demand will continue to weigh on exports,” said Zichun Huang, China economist at Capital Economics, with a further decline in exports seen likely before they bottom out towards the end of the year.

“But the good news is that the worst of the decline in foreign demand is probably already behind us,” she added.

Lv Daliang, a spokesperson for the General Administration of Customs, blamed the poor export performance on “a weak global economic recovery, slowing global trade and investment, and rising unilateralism, protectionism and geopolitics,” in comments at a news conference in Beijing.

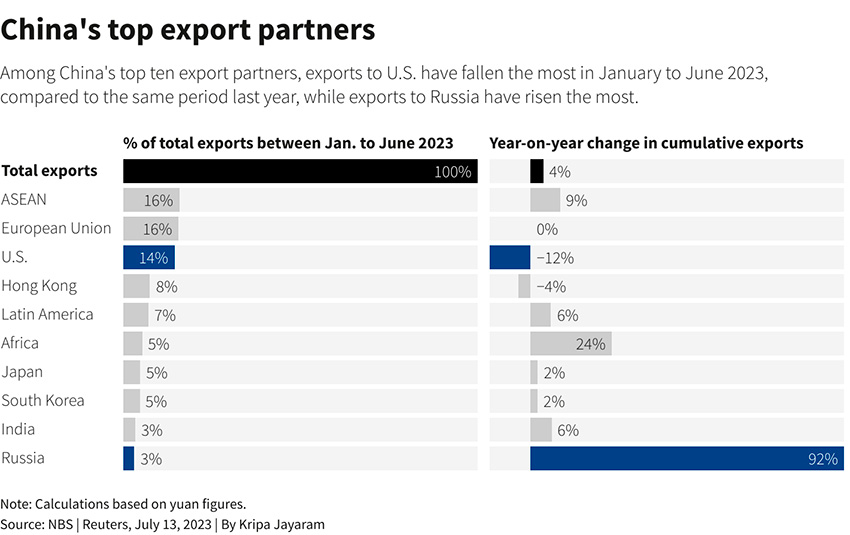

Exports to the United States – the top destination for Chinese goods – have fallen the most among its major trading partners over the first half of the year, as diplomatic tensions mount over chip technology and other issues, while exports to Russia have risen sharply, although from a modest level.

With exports accounting for about one-fifth of the economy and the troubled property sector for about one-third, China’s prospects have dimmed for a quick recovery after COVID-related lockdowns battered the economy in 2022.

A Reuters poll showed China’s economy likely grew 7.3% in the second quarter from a year earlier, when lockdowns in Shanghai and other big cities dampened output, while full-year growth was forecast at 5.5%. The statistics bureau will release second-quarter gross domestic product data next Monday.

The government has set a modest GDP growth target of around 5% for this year, after badly missing last year’s goal.

“Soft exports and deflationary pressure will add to calls for stimulus, but I don’t think the scale of support will be enormous,” said Xu Tianchen, senior economist at the Economist Intelligence Unit.

“This is owing to fiscal constraints on the government, they need to borrow more to fund larger expenditure,” he added.

PRESSURE FOR STIMULUS

Chinese Premier Li Qiang, who took up his post in March, has promised to roll out policy measures to boost demand and invigorate markets, but few concrete steps have been announced and investors are growing impatient.

The Chinese yuan slipped against the dollar after the data was released, but analysts said further currency weakness was expected to be limited as investors set their sights on next month’s Politburo meeting and any potential action on economic stimulus.

“The big question in the next few months is whether domestic demand can rebound without much stimulus,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management.

Factory activity in China has been shrinking in recent months, while consumer prices teetered on the edge of deflation in June and producer prices fell at their fastest pace in more than seven years.

Chinese imports of semiconductors fell 13.6% in June, slower than the 15.3% drop seen in May but signalling limited appetite among Chinese manufacturers for components to re-export in finished goods.

Demand for raw materials also showed signs of weakness, with copper imports down 16.4% in June compared with a year earlier.