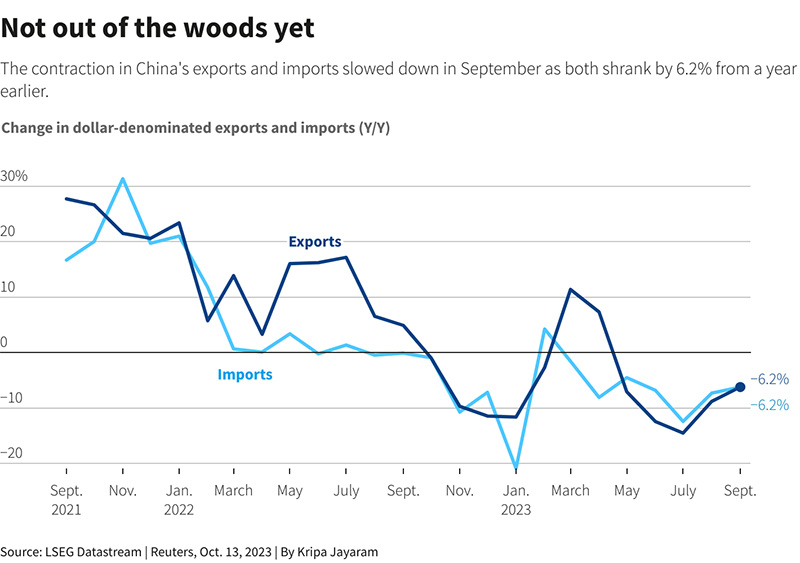

China released a mixed batch of economic data on Friday showing a slump in exports and imports was gradually easing, but lingering deflationary pressures underlined the challenges policymakers face in trying to engineer a stronger economic recovery.

China’s policy support measures over recent months have begun to stabilise some parts of the world’s second-biggest economy, but a long-running property crisis, a slowdown in global growth and geopolitical tensions continue to drag on broader activity as well as consumer and business confidence.

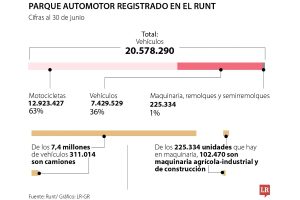

Exports in September declined 6.2% from a year ago, moderating somewhat from a drop of 8.8% in August, and beating economists’ forecast for a 7.6% fall in a Reuters poll.

The trend appeared to be backed up by new export orders in an official factory survey two weeks ago which showed improvement last month, partly because of a peak export shipping season for Christmas products and favourable base effects.

“There’s increasing evidence that the cyclical upturn in the global electronics sector is driving a bottoming-out of global trade and China’s trade data is the latest sign,” said Xu Tianchen, senior economist at the Economist Intelligence Unit.

“This gives reason for optimism about a rosier trade picture in 2024,” he added.

South Korean exports to China, a leading indicator of China’s imports, fell at their slowest pace in 11 months in September. Semiconductors make up the bulk of their trade, signalling improving appetite among Chinese manufacturers for components to re-export in finished goods.

Global trade activity, represented by the Baltic Dry Index, also reported notable growth in September.

However, Lv Daliang, spokesperson of the General Administration of Customs, said at a press conference on Friday that China’s trade still faces a complex and severe external environment.

China’s exports to the ASEAN nations, which have become the Asian giant’s largest trade partner amid rising tensions with the United States and Europe over trade, technology and geopolitics, contracted further in September from a month earlier.

Elsewhere, China’s commodities data also presented a mixed picture. Its crude oil imports in September grew nearly 14% from a year earlier, while imports of copper — used widely in the construction, transport and power sectors — fell 5.8% year-on-year.

Overall, though, total merchandise imports fell at a slower pace, down 6.3%, reflecting a gradual recovery in domestic demand. They missed the 6.0% decline forecast in the poll, but came in better than a 7.3% contraction in August.

That resulted in a broader trade surplus of $77.71 billion in September, compared with a $70 billion surplus expected in the poll and $68.36 billion in August.

Stocks in China largely tracked falls overseas, with the blue-chip CSI300 Index (.CSI300) falling 1%, as global markets fretted over stronger-than-expected U.S. inflation data and concerns the Federal Reserve will keep interest rates higher for longer.

HEADWINDS TO RECOVERY

Still, economists say it’s too early to make a call on how China’s domestic demand will pan out in coming months as the crisis-hit property sector, uncertainties over employment and household income and weak confidence among some private firms pose risks to a durable economic rebound.

Separate data on Friday showed China’s credit growth may also be steadying.

New bank lending jumped to 2.31 trillion ($316.15 billion) in September, according to the central bank, missing economists’ forecast for 2.50 trillion yuan but still marking a sharp rise from 1.36 trillion yuan in August.

“The housing market appears to have stabilised recently thanks to the latest round of property easing measures,” said Julian Evans-Pritchard, head of China Economics at Capital Economics, while signalling more policy support will likely be needed to shore up growth.

“The PBOC has hinted that additional monetary support is on its way… which in turn should underpin a partial economic recovery over the coming quarters,” he added.

“Monetary policy still has sufficient space to cope with any challenges and changes that exceed expectations,” Zou Lan, head of the monetary department of the People’s Bank of China, told a briefing.

Some economists are still not convinced China will be able to meet its annual growth target of around 5%, despite signs its downturn is bottoming out.

The $18 trillion economy started losing steam from the second quarter after a brief post-COVID bounce, prompting policymakers to roll out measures to shore up the recovery in the face of a sluggish housing market, high youth unemployment and mounting local government debt repayment pressures.

China’s economy is recovering and improving but officials should have a clear understanding of difficulties and challenges ahead, Premier Li Qiang was quoted by stae media as saying on Friday.

Li, during a meeting with economists and business executives, also said the government should further strengthen its policy reserves, according to state media.

DEFLATIONARY PRESSURES

Highlighting the deflationary pressures dogging the economy, China’s consumer prices faltered and factory-gate prices shrunk slightly faster than expected last month compared with a year earlier, inflation data released earlier on Friday showed,

Yet, authorities can take some comfort from recent data including upbeat factory activity and retail sales, while the past Golden Week holiday travel edged up 4.1% from pre-pandemic 2019 levels.

Beijing appears to be preparing a fresh round of stimulus to get activity on a more solid footing, though the impact may not be felt until well into 2024.

China is considering issuing at least 1 trillion yuan ($137.00 billion) of additional sovereign debt to fund infrastructure projects, Bloomberg News reported on Tuesday, citing people familiar with the matter.

Most analysts have reiterated in recent months that policymakers need to go further than introducing piecemeal measures in order to get the economic back on track.

“Whatever does emerge from Beijing over the coming months, it likely won’t be quick enough to make any meaningful difference to 2023,” said Robert Carnell, regional head of research Asia-Pacific at ING in a note.

“At best, it should be viewed as a pain management tool for the transition to a less leveraged economy.”

($1 = 7.2995 Chinese yuan renminbi)