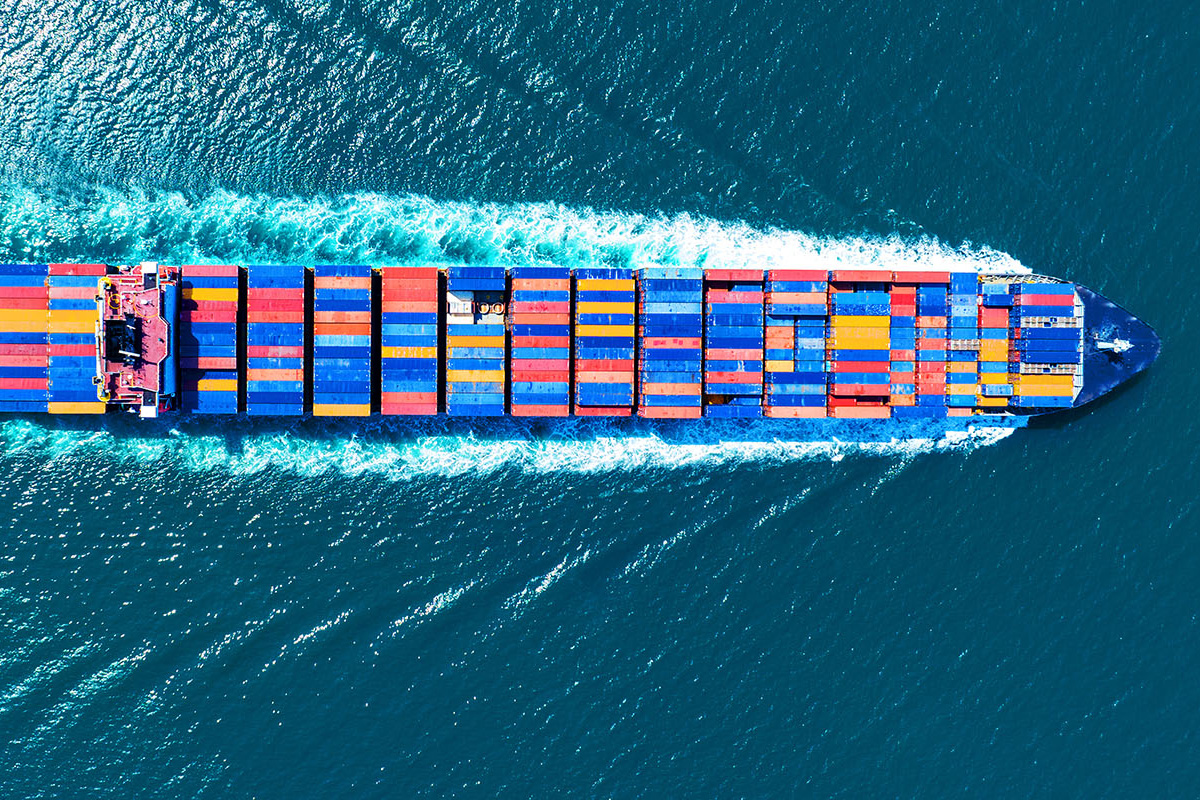

As the U.S. presidential election nears, tariffs and trade policy are among the most sensitive to the election’s outcome and could have a notable impact on the economy and your portfolio. Here’s what investors should know.

With less than a month left until the U.S. general election, investors are interested in the long-term economic and market-related impacts of the two candidates’ trade policies. In particular, each candidate’s position on tariffs could have a broad impact on the economy, gross domestic product (GDP), inflation, market performance and household expenses.

Where does each candidate stand on trade and tariffs?

The presidential candidates have varying views on trade policy, including the use of tariffs.

- Vice President Kamala Harris has provided little guidance on her perspective, but has not expressed a desire to change the current tariff structure, which indicates that her policies may remain largely consistent with those of the Biden administration. Biden has mostly upheld the tariffs originally put in place by the Trump administration in 2020. However, without more detail from Harris regarding trade and tariff policy, there could be a potential risk for investors seeking to mitigate exposure to certain policy changes.

- By contrast, former President Donald Trump has put forth plans for an aggressive tariff regime. His proposals include raising tariffs to 60% on Chinese goods and introducing a universal tariff in the 10%-20% range. An aggressive tariff regime could increase US inflation and negatively impact productivity and growth.

Based on the details both candidates have outlined thus far, here are four takeaways investors should know.

-

1How have existing tariffs affected households?

While the existing tariff regime may not have fanned broad inflationary pressures, it did translate to higher costs for U.S. consumers. The Tax Foundation determined that the current tariffs—introduced during the Trump administration and continued under Biden—along with China’s retaliatory responses, resulted in what may be considered an $80 billion annual tax on U.S. citizens and an estimated $200 to $300 in annual costs per household, on average. Importantly, these estimates may understate the impact of existing tariffs due to shifting consumer choices or reduced income from lower output.

-

2How could a change to tariff policies impact inflation?

While trade policy would likely stay consistent under a Harris administration, Trump’s proposed tariff hikes could increase U.S. inflation and negatively impact productivity and growth. In an assessment of Trump’s proposed plans, an increase of tariffs to 60% on China and a 10% universal tariff would add 2.5% inflation and reduce GDP by 0.5% in the first two years of being enacted.

-

3Would an increase in tariffs hurt the U.S. economy and/or stock market?

The impact of tariffs varies depending on the business cycle, with their introduction having a greater drag on productivity when the economy is in expansion. According to a 2019 study by the International Monetary Fund, a 5% increase in tariffs during economic expansion could decrease productivity by approximately 1% over five years. On the other hand, tariffs are found to increase productivity when the economy is in contraction, but results were not found to be statistically significant. Tariff increases thus have a greater negative effect on productivity during favorable economic conditions, and little positive impact when tariffs are levied during recessionary periods.

The impact of tariffs on the stock market also varies. Certain industries, such as the solar and steel industries, have taken a particular hit from increased tariffs. For example, in January 2018, the Trump administration imposed tariffs on solar panels and washing machines of 30% and 50%, respectively. In March of the same year, the administration imposed a 25% tariff on steel and 10% on aluminum from most countries, covering an estimated 4.1% of U.S. imports. Following these measures, both solar and steel companies underperformed the S&P 500 until mid-2019.

-

4How can I potentially reduce the impact of tariffs in my portfolio?

Although the candidates’ trade policies are still evolving, there is a notable divergence between their approaches. While Harris’ trade policy is likely to mirror the current environment, she has not revealed much about her plans for tariffs, creating some uncertainty for investors. On the other hand, Trump’s proposal for increased tariffs may drag productivity and growth, and add inflationary pressure. Should tariffs rise and economic conditions weaken, investors can consider defensive sectors such as Consumer Staples, Health Care, Utilities and select retailers with less exposure to offshore production.

Información extraída de: https://www.morganstanley.com/articles/election-2024-trade-policy-investing