As stocks snap a three-day losing streak and return to climbing the proverbial wall of worry, the VIX is signaling the most complacency in stocks since just prior to the pandemic.

It may not signal the all-clear, the low VIX reading does underscore the powerful rally U.S. large cap equities have mounted this year. While the rally was largely concentrated in growth tech names and mega cap stocks through May, cyclical sectors have joined the party since the last jobs report dropped in early June.

The VIX is perhaps most famous for its skyward spikes during periods of market turmoil. But sustained, lower readings are a hallmark of bull markets.

Former options market maker and current chief strategist at Interactive Brokers, Steve Sosnick, explains the dynamic between the VIX, which is derived from the options market on S&P 500 stocks, and the underlying stocks.

“VIX is a key tool for portfolio managers who want to hedge their risks. The low level of VIX tells us that there is not much demand for protection from institutions,” writes Sosnick.

Yet, a similar gauge in the bond market shows a different story.

Above shows the BofA ICE Move Index (^MOVE), which has come well off its highs this year. However, it remains quite elevated relative to readings prior to the pandemic.

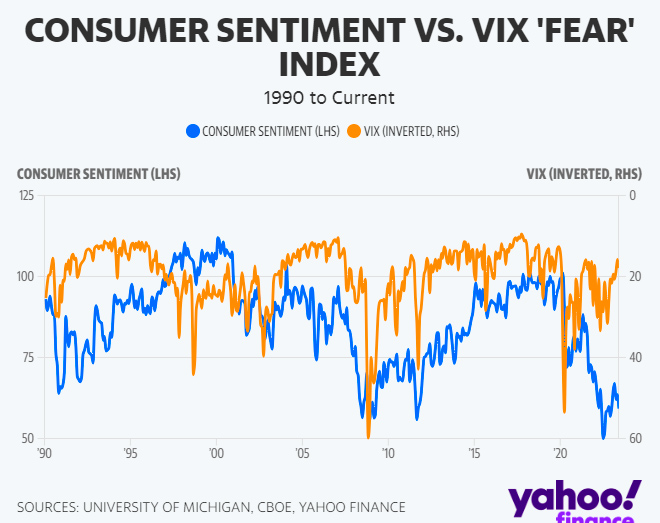

And comparing sentiment in the stock market to sentiment among consumers illustrates an even more divergent story.

The University of Michigan consumer sentiment index (blue, above), is coming off the lowest level since its start in 1977. The VIX index (orange, above) is inverted such that spikes lower indicate panic in stocks.

The chart shows that the last period of similarly low consumer sentiment came just after Lehman Brothers failed in 2008 during the Global Financial Crisis. It was met with a concurrent spike in market turmoil, as measured by the VIX (and the MOVE index as well).

So what does this suggest is in store for the present?

While this “gap” between the consumer and Wall Street remains stretched, it needn’t necessarily close. However, it would be historically unusual to see the disconnect remain this large.

All of which suggests the consumer will finally cheer up and “catch up” to Wall Street complacency, or panic in stocks will “catch down” to depressed sentiment levels.

But not without a catalyst, which could be weeks away.

“We have put another FOMC decision and semi-annual testimony by the Fed Chair in the rearview mirror. At the same time, we have roughly another month until 2Q earnings season begins in earnest and few ‘known unknowns’ in the ensuing weeks,” writes Sosnick. “Smooth sailing, right?”