U.S. investors were big buyers of equity funds in the seven days through Nov. 15, spurred by expectations that the Federal Reserve may pause its interest rate hikes in light of recent subdued U.S. inflation data.

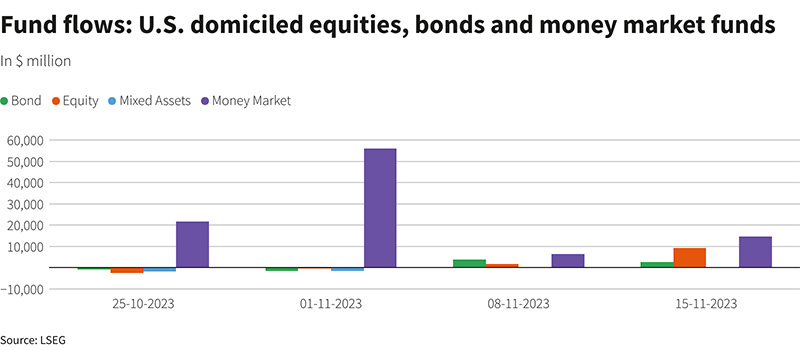

LSEG data shows that U.S. equity funds attracted about $9.33 billion in net inflows during the week, marking the largest weekly net purchase since Sept. 13.

Large-cap U.S. funds led the charge, securing $8.54 billion in net inflows, the highest in two months. Small- and multi-cap funds also saw substantial inflows, garnering $1.23 billion and $1.01 billion, respectively. However, mid-cap funds experienced net outflows totalling $1.13 billion.

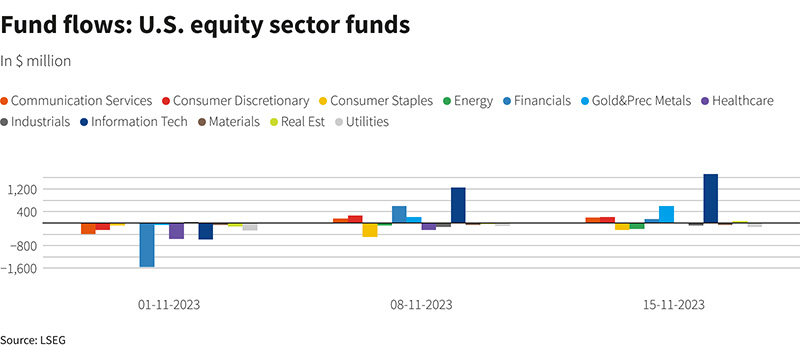

Technology sector funds were a prime target for investors, who injected a net $1.73 billion, the largest inflow since mid-December 2021. Gold & precious metals, and consumer discretionary sectors also attracted significant inflows, amounting to $596 million and $212 million, respectively.

U.S. bond funds reported $2.67 billion in net purchases, continuing a trend of inflows for the second consecutive week. High-yield funds, riding on improved risk sentiment, garnered $4.5 billion, following a robust $6.3 billion net purchase in the prior week.

Conversely, U.S. short/intermediate government and treasury funds, along with general domestic taxable fixed income funds, saw withdrawals of $1.13 billion and $897 million, respectively.

The week also saw investors channel approximately $14.69 billion into money market funds, marking a fourth consecutive week of net buying.