Visualized: Real Interest Rates of Major World Economies

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on real assets and resource megatrends each week.

Interest rates play a crucial role in the economy because they affect consumers, businesses, and investors alike.

They can have significant implications for people’s ability to access credit, manage debts, and buy more expensive goods such as cars and houses.

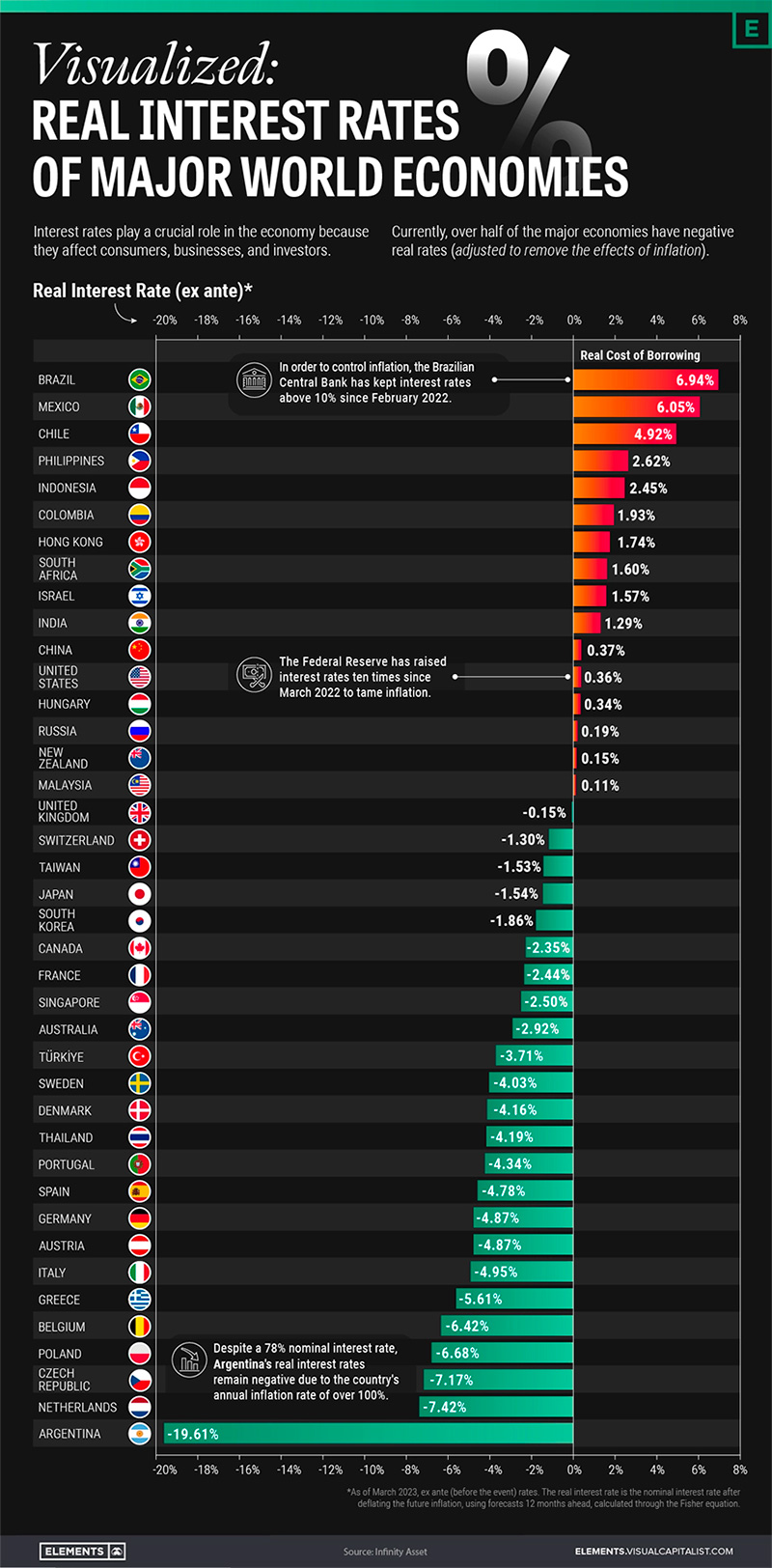

This graphic uses data from Infinity Asset Management to visualize the real interest rates (ex ante) of 40 major world economies, by subtracting projected inflation over the next 12 months from current nominal rates.

Nominal Interest Rates vs. Real Interest Rates

Nominal interest rates refer to the rate at which money can be borrowed or lent at face value, without considering any other factors like inflation.

Meanwhile, the real interest rate is the nominal interest rate after taking into account inflation, reflecting the true cost of borrowing or lending. Real interest rates can fluctuate over time and are influenced by various factors such as inflation, central bank policies, and economic growth. They can also influence economic growth by affecting investment and consumption decisions.

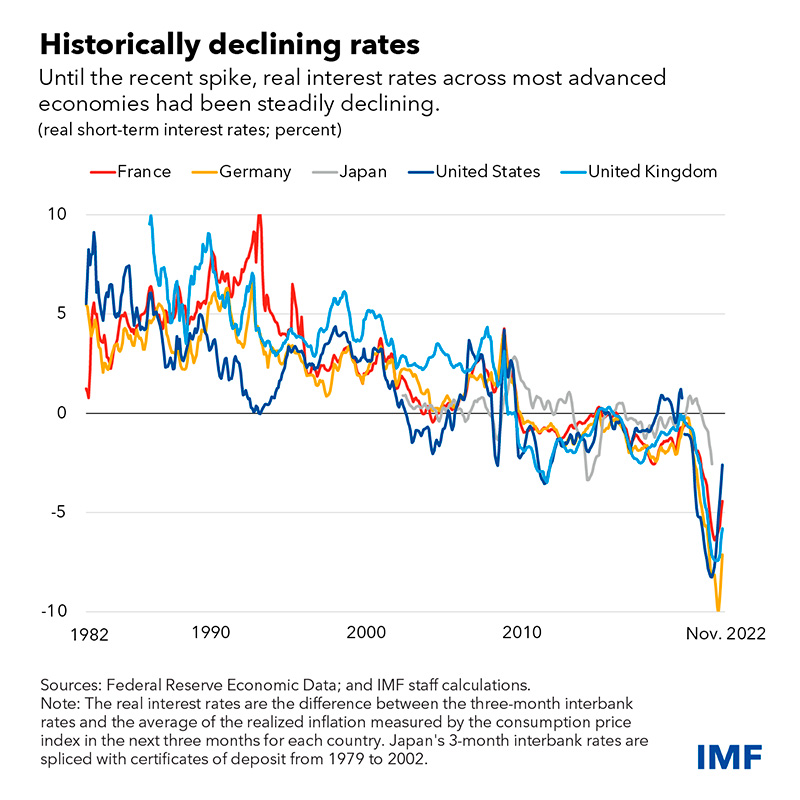

According to the International Monetary Fund (IMF), since the mid-1980s, real interest rates across several advanced economies have declined steadily.

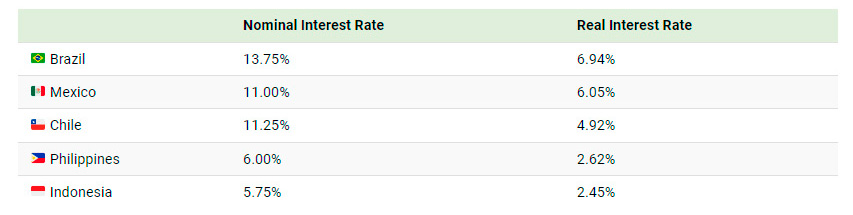

As of March 2023, Brazil has the highest real interest rate among the 40 major economies shown in this dataset.

Below we look at Brazil’s situation, along with the data of the four other major economies with the highest real rates in the dataset:

In general, countries with high interest rates offer investors higher yields on their investments but also come with higher risks due to volatile economies and political instability.

Below are the five countries in the dataset with the lowest real rates:

Hyperinflation, as seen in Argentina, can lead to anomalies in both real and nominal rates, causing problems for the country’s broader economy and financial system.

As you can see above, with a 78% nominal interest rate, Argentina’s real interest rates remain the lowest on the planet due to a staggering annual inflation rate of over 100%.

Interest Rate Outlook

Increasing inflation and tighter monetary policy have resulted in rapid increases in nominal interest rates recently in many countries.

However, IMF analysis suggests that recent increases could be temporary.

Central banks in advanced economies are likely to ease monetary policy and bring interest rates back to pre-pandemic levels when inflation is brought under control, according to the fund.