The Global Demand for Oil (2022-2045F)

Economists have been attempting to forecast the point of peak oil—the year when oil demand reaches its maximum level—since the 1970s. Despite increasing warnings regarding climate change, global demand has continued to rise over the last few years and could continue.

In this graphic, Visual Capitalist partnered with Range ETFs to explore the global oil demand and determine which region will demand the most in 2045.

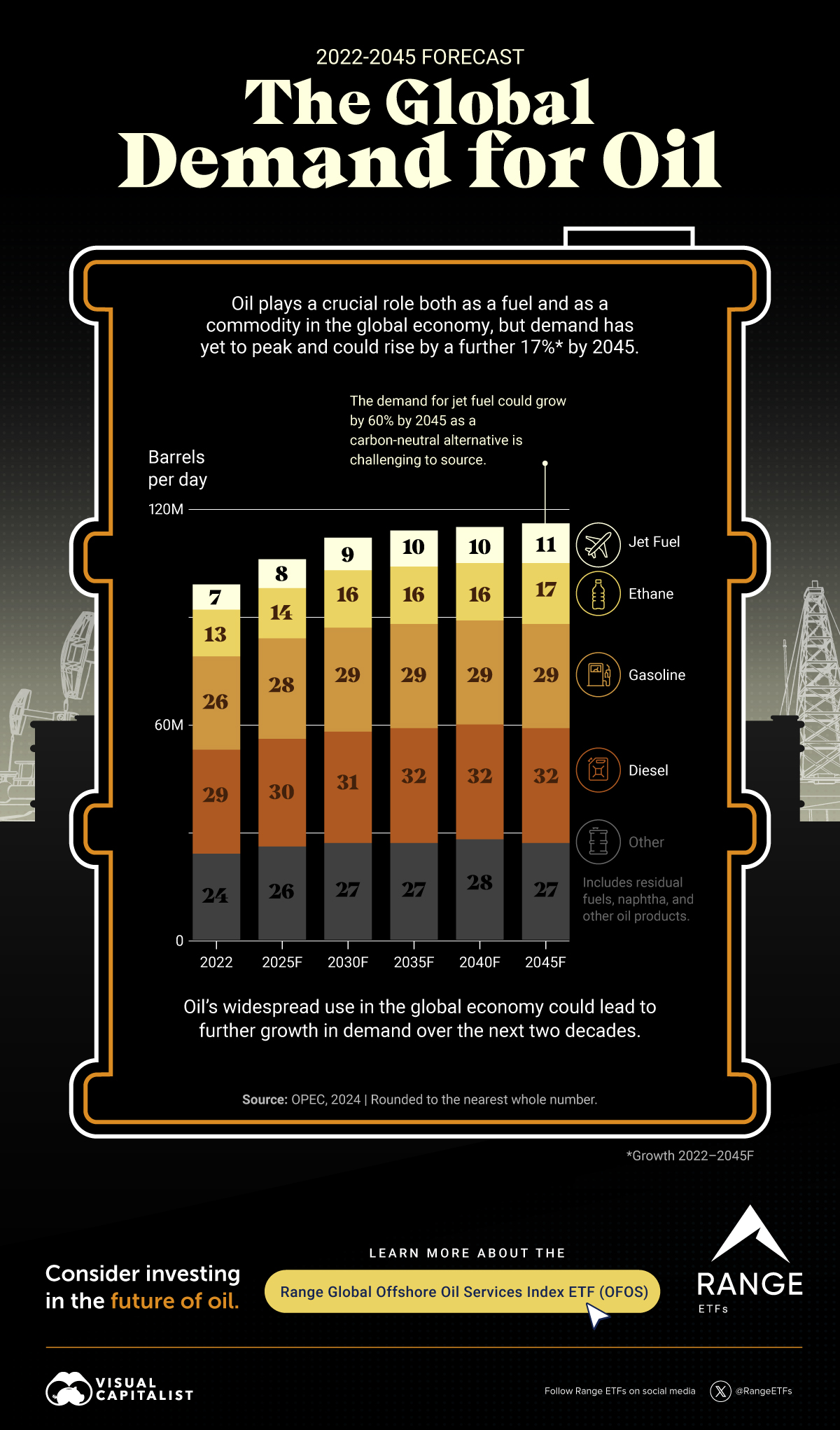

Projecting Global Oil Demand

As per OPEC, Oil demand could be as much as 17% higher by 2045 than it was in 2022. These projections are in millions of oil barrels per day and broken down by oil product.

| Oil Product | 2022 | 2025F | 2030F | 2035F | 2040F | 2045F |

|---|---|---|---|---|---|---|

| Jet Fuel | 7 | 8 | 9 | 10 | 10 | 11 |

| Gasoline | 26 | 28 | 29 | 29 | 29 | 29 |

| Diesel | 29 | 30 | 31 | 32 | 32 | 32 |

| Ethane | 13 | 14 | 16 | 16 | 16 | 17 |

| Other | 24 | 26 | 27 | 27 | 28 | 27 |

| Total | 99 | 106 | 112 | 114 | 115 | 116 |

Oil’s importance in the global economy and its role as a fuel in many nations and industries worldwide contribute to the strength in demand. Additionally, the demand for jet fuel could grow by as much as 60% between 2022 and 2045, as currently, there is no carbon-neutral alternative to kerosene.

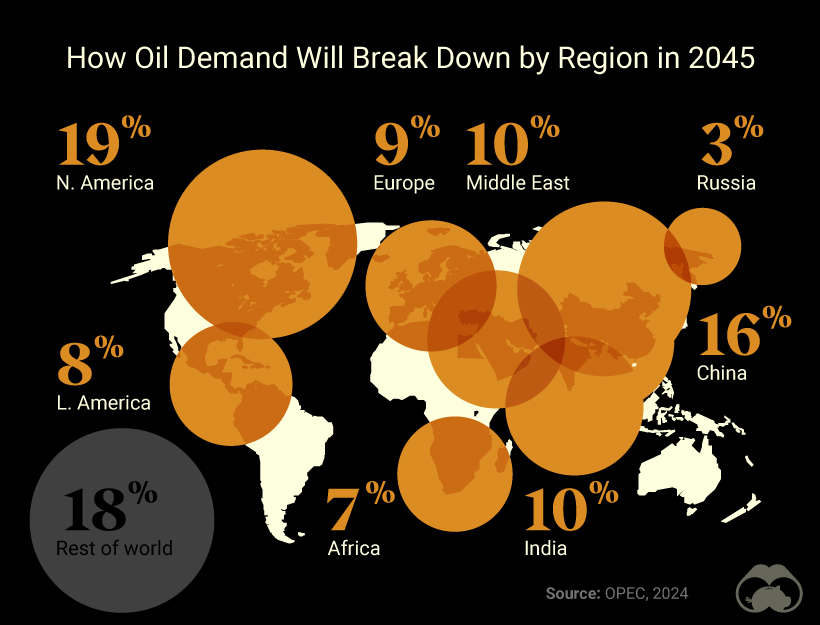

Who Will Be Using This Oil?

The forecasts also describe how much of this demand could flow to each region by 2045. Here is how it breaks down:

Despite significant investments in clean energy, large economies like those in North America, China, and India are forecast to have the most demand in 2045. This would be driven by each region’s need to use oil in transportation, industrial processes, and energy generation.

The Future of Oil

Oil’s continued importance as a fuel will likely keep demand growing over the next two decades.

Investors can take advantage of the growing potential oil demand by gaining exposure to various companies at the forefront of the offshore oil industry through the Range Global Offshore Oil Services Index ETF (OFOS).

Información extraída de: https://www.visualcapitalist.com/sp/rfh01-oil-demand/