Holding cash and short-dated bonds has been a winning combination this year.

Considering the six-month Treasury yield of 5.5% is near the S&P 500SPX +0.44% earnings yield, holding nearly risk-free government bonds in the first half of 2023 “was kind of a no-brainer,” says Lori Van Dusen, CEO and founder of LVW Advisors.

It’s tempting to stay in the perceived safety of cash and the short end, but financial advisors and bond market watchers say investors who have their liquidity needs covered should venture out on the yield curve into slightly longer-dated to intermediate-term bonds to lock in higher rates. Even if the Federal Reserve lifts interest rates one or two more times this year, the central bank is closer to the end than the beginning of its aggressive rate-hiking cycle.

Janet Rilling, senior portfolio manager and head of the Plus Fixed Income team at Allspring Global Investments, says timing the “Goldilocks moment” of buying longer-dated bonds just before the Fed cuts rates is hard. Investors who wait too long risk losing out when the rate cuts start.

The market is currently in a pre-Goldilocks moment, she says, but the good news is investors don’t need to time rate cuts. Rilling’s research shows that over the past 30 years of Fed rate cuts, investors benefited from lengthening their bond exposure between the time when the 10-year Treasury note yield peaks and the Fed starts cutting rates. Rilling suggests the 10-year note yield likely peaked in October at around 4.2%. It’s currently at 4%.

“If the playbook follows the last four cycles in the past 30 years, this would be a good time to start moving out your duration,” she says. Duration is a measure of interest-rate risk tied to a bond’s or bond fund’s maturity, yield, and other factors.

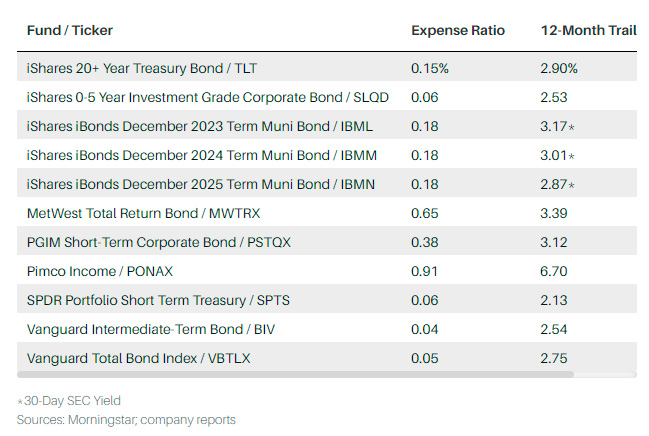

Diversify With These Bond Funds

Financial advisors are using these 11 bond mutual funds and ETFs in their portfolios.

Rilling’s team at Allspring advocates keeping 25% of the fixed-income portfolio in short-term vehicles and deploying the other 75% across the yield curve for diversification.

That’s what Robert Gilliland, managing director and senior wealth advisor at Concenture Wealth Management, is doing, diversifying his fixed-income portfolios with both duration and asset types.

MORE IN FUNDS QUARTERLY

- Growth Is Back. Where to Invest Now.

- The S&P 500 Is a Megacap Tech Fund. Where to Invest Instead.

He’s using the iShares 20+ Year Treasury BondTLT –0.30% exchange-traded fund (ticker: TLT) to extend duration; and the Vanguard Intermediate-Term BondBIV +0.26% ETF (BIV), a rough mix of high-quality government bonds and investment-grade corporate bonds, and the iShares 0-5 Year Investment Grade Corporate BondSLQD +0.14% ETF (SLQD) for yield and diversification. The shorter-dated bonds add yield, while the longer-dated Treasury bonds offer a cushion for when the Fed eventually cuts rates. Being index funds, the annual expense ratios of those funds are low, at 0.15%, 0.04%, and 0.06%, respectively.

For investors who are underweight fixed income, Gilliland recommends adding exposure gradually and consistently to take advantage of potential changes in short-term rates. “You don’t want to be revolutionary, you want to be evolutionary. You don’t all of a sudden want to go from being short and ultrashort to suddenly owning a whole bunch of long paper,” he says.

Gillibrand isn’t alone with using the iShares 20+ Year Treasury Bond ETF. Steve Laipply, global co-head of iShares fixed income ETFs at BlackRock, says that fund has gathered $11 billion in assets this year through mid-June.

RELATED MARKET DATA

Investors don’t need to extend duration far, says Gregory Peters, managing director and co-chief investment officer of PGIM Fixed Income. They are well-served staying in the shorter end of the yield curve, defined at 10 years or less. He doesn’t see the central bank cutting rates anytime soon because inflation remains stubbornly elevated.

“I’m not saying you need to be ultrashort and in cash, but I’m suggesting that there’s no reason to chase out on the curve, take on duration, take on substantial credit risk at this point in the cycle,” he says.

Peters and Rilling are both cautious on credit, given the uncertain economic environment, and recommend investors stick with high-quality bonds. They both use certain structured and securitized products, such as high-quality agency-backed securities, nonagency mortgaged-backed securities, commercial mortgage-backed securities, and AAA- and AA-rated collateralized loan obligations, all of which have performed well in 2023.

A number of financial advisors are using several actively managed and indexed bond funds to get access to structured products. At the top of the list for several advisors is the stalwart Pimco IncomePONAX –0.68% fund (PONAX), known for its strength in the nonagency mortgage-backed securities market. The Pimco fund has 39% of its holdings in government bonds and 21% in securitized bonds. It has a three-year effective duration, making it a good choice if the Fed keeps rates higher, and a 12-month yield of 6.7%. It costs 0.91% annually.

Van Dusen uses the Pimco fund along with the Vanguard Total Bond Index fund (VBTLX). The Vanguard fund has an effective duration of 6.5 years. making it a good choice if the Fed cuts rates. She flags the fund’s combination of high-quality credit, short-to-intermediate term Treasuries, and agency bonds. It has a yearly expense ratio of 0.05% and a 12-month yield of 2.75%.

As an alternative to Pimco’s fund, Derek Pszenny, managing partner at Carolina Wealth Management likes the actively managed MetWest Total Return Bond fund (MWTRX) as a core bond fund, because managers are nimbler than an indexed ETF in this uncertain time. The fund has an effective duration of 6.9 years and a 3.4% 12-month yield. It’s also heavily overweight securitized bonds versus peers, with 47% of the fund in that sector. It costs 0.65% annually.

Matt Dmytryszyn, chief investment officer at Telemus Capital, is wary of taking interest-rate risk right now because of the economic uncertainty, so he’s sticking to the short-end of curve. He’s mixing the SPDR Portfolio Short Term Treasury ETF (SPTS), which has an effective duration of 1.88 years and a yield of 2.13%, with the actively managed PGIM Short-Term Corporate Bond (PSTQX). They cost 0.06% and 0.38%, respectively.

The PGIM fund holds 80% investment-grade bonds and 16% structured products, with an effective duration of 2.67 years and a yield of 3.12%. Dmytryszyn says the high-quality collateralized loan obligations and commercial mortgage-backed securities boost the yield, and he believes the fund’s the low duration and the high-quality bonds it holds may make it less vulnerable if a recession hits.

Tax-sensitive investors shouldn’t overlook opportunities in the municipal bond market. Like Treasuries, the muni-bond curve is also inverted, where short-dated bonds yield more than long-dated bonds, says Stephen Tuckwood, director of investments at Modern Wealth Management.

He prefers iShares’ iBond ETFs as a diversified and efficient way to ladder muni bonds. The investment-grade muni bond ETFs have a defined maturity and regular income distribution. He’s sticking with a duration of five years or less, and tends to equal-weight each year across the ladder.

For example, a three-year ladder using the iShares iBonds Dec 2023 Term Muni Bond ETF (IBML), iShares iBonds Dec 2024 Term Muni Bond ETF (IBMM) and iShares iBonds Dec 2025 Term Muni Bond ETF (IBMN) achieves a blended 30-Day SEC yield of 3.02%, which works out to a tax-equivalent SEC yield of 5.33%, depending on the individual’s state and tax bracket.

“It’s all the benefits of a bond ladder with the ease of an ETF,” he says.

BlackRock’s Laipply says investors should be less worried about picking their duration sweet spot and more focused on adding fixed-income holdings if they haven’t already.

“We’ve seen this tremendous opportunity arise over the last year because of the tightening cycle. Yields have repriced,” Laipply says.