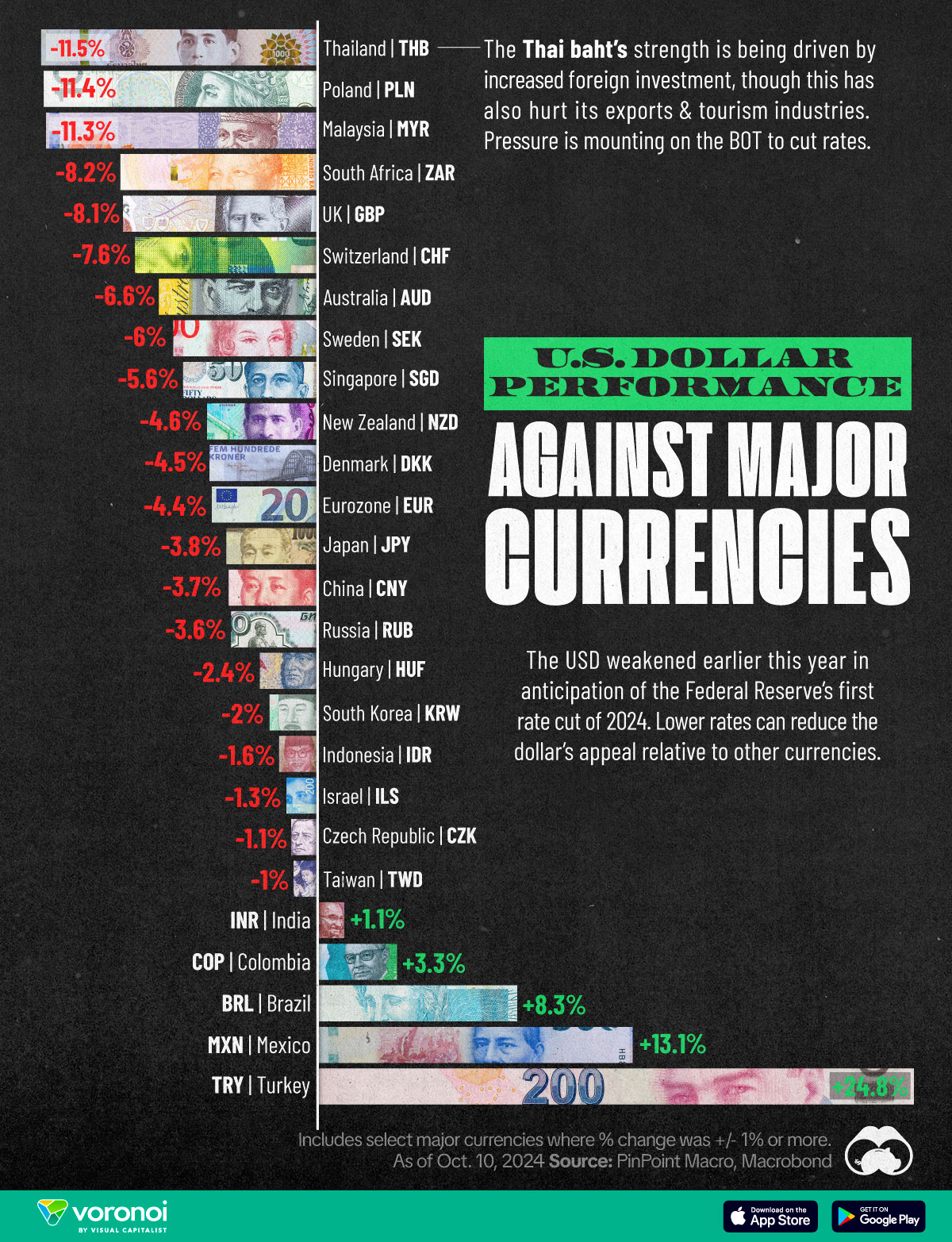

U.S. Dollar Performance Against Major Currencies in 2024

In 2024, the U.S. dollar has experienced notable depreciation against many major currencies due to anticipation of the Federal Reserve’s first rate cut since the onset of the COVID-19 pandemic (rates were cut by 0.5% in September 2024).

Lower rates can reduce the dollar’s appeal relative to other currencies, particularly those in economies with higher interest rates.

With this in mind, we’ve visualized U.S. dollar performance in 2024, as of October 10, 2024 using data from PinPoint Macro Analytics.

Data and Key Takeaways

The figures shown in this graphic are also listed in the table below. Negative values mean the U.S. dollar has depreciated against that currency.

| Country | Currency | % Change |

|---|---|---|

| 🇹🇭 Thailand | THB | -11.5 |

| 🇵🇱 Poland | PLN | -11.4 |

| 🇲🇾 Malaysia | MYR | -11.3 |

| 🇿🇦 South Africa | ZAR | -8.2 |

| 🇬🇧 UK | GBP | -8.1 |

| 🇨🇭 Switzerland | CHF | -7.6 |

| 🇦🇺 Australia | AUD | -6.6 |

| 🇸🇪 Sweden | SEK | -6 |

| 🇸🇬 Singapore | SGD | -5.6 |

| 🇳🇿 New Zealand | NZD | -4.6 |

| 🇩🇰 Denmark | DKK | -4.5 |

| 🇪🇺 Eurozone | EUR | -4.4 |

| 🇯🇵 Japan | JPY | -3.8 |

| 🇨🇳 China | CNY | -3.7 |

| 🇷🇺 Russia | RUB | -3.6 |

| 🇭🇺 Hungary | HUF | -2.4 |

| 🇰🇷 South Korea | KRW | -2 |

| 🇮🇩 Indonesia | IDR | -1.6 |

| 🇮🇱 Israel | ILS | -1.3 |

| 🇨🇿 Czech Republic | CZK | -1.1 |

| 🇹🇼 Taiwan | TWD | -1 |

| 🇮🇳 India | INR | 1.1 |

| 🇨🇴 Colombia | COP | 3.3 |

| 🇧🇷 Brazil | BRL | 8.3 |

| 🇲🇽 Mexico | MXN | 13.1 |

| 🇹🇷 Turkey | TRY | 24.8 |

From this dataset we can see that the U.S. dollar has depreciated the most against the Thai baht (THB), Polish złoty (PLN), and the Malaysian ringgit (MYR).

At the other end of the scale, the U.S. dollar has appreciated the most against the Turkish lira (TRY) and the Mexican peso (MXN).

Pros and Cons of a Weaker U.S. Dollar

Here are some advantages of a weaker U.S. dollar:

- Boosts U.S. exports: A weaker dollar makes U.S. goods and services cheaper abroad, which could help businesses in manufacturing and export-driven sectors

- Increased tourism in the U.S.: A weaker dollar could also attract more foreign tourists to the U.S., meaning more visitors to hotels, restaurants, and even national parks

On the flipside, here are some disadvantages:

- Costlier for Americans to travel: A weaker dollar means American tourist money doesn’t go as far in foreign countries (though it could be a good time to book that Mexico trip)

- More expensive imports: Goods that are manufactured abroad or rely on foreign parts may see price increases

Información extraída de: https://www.visualcapitalist.com/u-s-dollar-performance-against-major-currencies-in-2024/