The Dow Jones Industrial Average reversed lower Friday after a key consumer sentiment gauge, which included an inflation survey for future expectations. Meanwhile, Tesla (TSLA) stock gave up early gains after Chief Executive Elon Musk tweeted that he found a new CEO to run Twitter.

The University of Michigan’s consumer sentiment index fell to 57.7 in May, down from April’s 63.5 reading. Wall Street expected a 63.0 reading for May.

Meanwhile, one-year and five-year inflation expectations are also included in the survey. May’s one-year inflation expectation dipped to 4.5% from April’s 4.6%. Further, May’s five-year expectations rose to 3.2% vs. April’s 2.9%. (For the latest coverage of the market, visit our Stock Market Today page.)

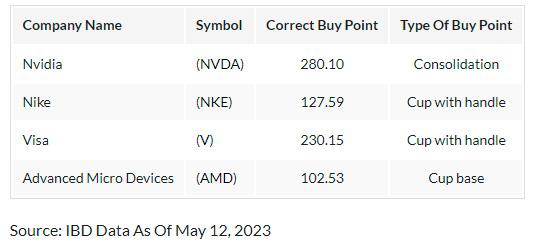

Advanced Micro Devices (AMD), IBD Leaderboard stock Nvidia (NVDA), IBD SwingTrader idea Netflix (NFLX) and Uber Technologies (UBER) — as well as Dow Jones stocks Nike (NKE) and Visa (V) — are among the best stocks to buy and watch in the stock market uptrend.

Visa was featured in this week’s Stocks Near A Buy Zone column. Netflix and Nvidia were recent IBD Stock Of The Day topics.

Dow Jones Today: Oil Prices, Treasury Yields

After Friday’s opening bell, the Dow Jones Industrial Average inched lower, and the S&P 500 lost 0.1%. The tech-heavy Nasdaq composite dropped 0.3% in morning action, with China names NetEase (NTES), Baidu (BIDU) and JD.com (JD) trading near the bottom of the list.

Among U.S. exchange-traded funds, the Nasdaq 100 tracker Invesco QQQ Trust (QQQ) fell 0.2%, while the SPDR S&P 500 ETF (SPY) traded down 0.1% early Friday.

The 10-year U.S. Treasury yield on Friday traded at 3.39%, still on pace for modest weekly losses in the wake of the CPI and PPI reports.

U.S. oil prices continued to bob between $70 and $72 a barrel. West Texas Intermediate futures are about even for the week, and down not quite 6% since the start of the month. Baker Hughes weekly rig count survey could affect on Friday’s trading, as it is due for release at 1 p.m. ET.

Stock Market Rally

On Thursday, the Dow Jones Industrial Average lost 0.7%, extending a losing streak to four sessions. The index bounced off its 50-day line, however. The S&P 500 declined 0.2%, and the tech-heavy Nasdaq composite rose 0.2%.

Thursday’s Big Picture column commented, “Wednesday’s march to new 2023 highs on the Nasdaq prompted a market-trend upgrade from “uptrend under pressure” to “confirmed uptrend.” Despite the acknowledgment of better action in recent sessions, IBD’s recommended exposure in stocks remains at 20% to 40% of your portfolio.”

Now is an important time to read IBD’s The Big Picture column after this week’s bullish stock market gains.

Dow Jones Stocks To Buy And Watch: Nike, Visa

Nike shares declined 1% Thursday, further below a cup-with-handle’s 127.59 buy point after last week’s breakout attempt. A new handle entry has also appeared, at 128.78. Shares are looking for support around their 50-day line. NKE stock fell 1.2% early Friday.

Visa shares remain in buy range above a 230.15 cup-with-handle buy point, even after dipping another 0.1% Thursday. The buy range goes up to 241.66. V stock was up 0.5% Friday.

Best Stocks To Buy And Watch: AMD, Nvidia, Netflix, Uber

Chip leader Advanced Micro Devices continues to rally up the right side of a cup base that has a 102.53 buy point, according to IBD MarketSmith pattern recognition. Monday’s surge saw AMD stock climb above an early trendline entry, using May 4’s high of 91.64 as the buy point. AMD shares rose 0.1% Friday.

IBD Leaderboard stock Nvidia finished Thursday down 1.1%, still in buy range above a 280.10 buy point in a short consolidation. The 5% buy zone goes up to 294.11. NVDA stock was up 0.4% early Friday.

Recent IBD Stock Of The Day, Netflix, popped above its 50-day moving average line Monday. That positive action created a buying opportunity for aggressive investors. Further, Netflix shares now are near a buy point of 349.90 out of a cup-with-handle base. NFLX stock inched lower Friday morning.

Uber Technologies remains in buy range past a 7.68 buy point in a cup base, despite a 0.95% fall Thursday. The 5% buy area goes up to 39.56. The stock was up 0.5% Friday.

Best Stocks To Buy And Watch In Stock Market Rally

These are four best stocks to buy and watch in today’s stock market, including two Dow Jones leaders.

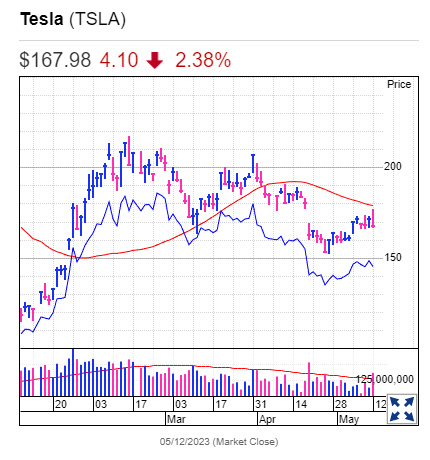

Tesla Stock

Tesla stock rallied 2.1% Thursday, ending a two-day skid. Despite gains since late April, shares remain below their 50-day line, as they look to build a new base. The stock closed Thursday 46% off its 52-week high.

TSLA stock looked to add to Thursday’s gains, but gave up sharp gains to fall 0.3% Friday morning after Musk announced he had found a new Twitter chief.

Late Thursday, Musk tweeted, “Excited to announce that I’ve hired a new CEO for X/Twitter. She will be starting in ~6 weeks! My role will transition to being exec chair & CTO, overseeing product, software & sysops.”

While Musk did not name the new CEO, the Wall Street Journal reported that NBCUniversal’s head of advertising, Linda Yaccarino, is in talks for the job.

Dow Jones Leaders: Apple, Microsoft

Among Dow Jones stocks, Apple shares inched higher Thursday, closing just shy of their 52-week high, which was set back in mid-August. The stock continues to add to gains above a 157.48 buy point and is out of the buy range that ran up to 165.35. AAPL stock was down 0.7% Friday.

Microsoft shares fell 0.7% Thursday, easing from Wednesday’s 52-week high price of 313. Shares are sharply above a 276.86 flat-base buy point. On Friday morning, MSFT stock dropped 1%.

Information extracted from: https://www.investors.com/market-trend/stock-market-today/dow-jones-rise-inflation-survey-tesla-stock-rallies-elon-musk-tweet/?src=A00220