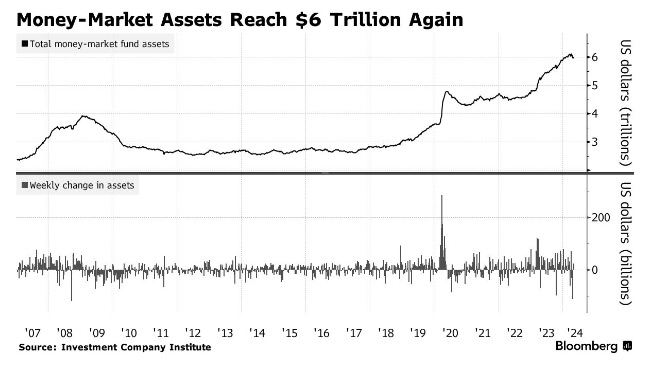

Money-market fund assets rose above $6 trillion for the first time in three weeks on expectations short-term rates will remain elevated after Federal Reserve policymakers signaled they are in no rush to ease monetary policy.

About $23.6 billion flowed into US money-market funds in the week through May 1, according to Investment Company Institute data. Total assets rose to $6 trillion from $5.98 trillion in the prior week.

The inflows come as the tax season winds down and after Fed Chair Jerome Powell said the central bank is prepared to hold its target policy rate at a two-decade high for as long as it takes to gain confidence that inflation is in hand. This week, policymakers decided unanimously to leave the benchmark federal funds rate in a range of 5.25% to 5.5%, the highest since 2001, for a sixth straight meeting.

Retail investors have piled into money funds since the Fed began one of the most-aggressive tightening cycles in decades in 2022. On the institutional side, cash left prime money-market funds, an indication investors are starting to shift their allocations ahead of the Securities and Exchange Commission’s latest set of regulations, which are slated to take effect later this year.

In a breakdown for the week to May 1, government funds — which invest primarily in securities such as Treasury bills, repurchase agreements and agency debt — saw assets rise to $4.86 trillion, a $21.3 billion increase. Prime funds, which tend to invest in higher-risk assets such as commercial paper, saw assets rise to $1.02 trillion, an $870 million increase.