Nasdaq led Wall Street lower on Friday as shares of chip-equipment makers fell after the world’s top semiconductor firm, TSMC, asked its vendors to delay chip equipment deliveries, while rising Treasury yields pressured major megacap stocks.

Applied Materials (AMAT.O), Lam Research (LRCX.O) and KLA Corp (KLAC.O) fell more than 2% each after Reuters reported about TSMC’s move (2330.TW), weighing down the tech-heavy Nasdaq (.IXIC).

Denting sentiment further, the 10-year Treasury yield rose, dragging down growth stocks Amazon (AMZN.O), Nvidia (NVDA.O) and Microsoft (MSFT.O) between 1.4% and 2.1%.

Adobe (ADBE.O) dropped 4.0% to a more than two-week low after the Photoshop software maker disclosed a commercial paper program of up to $3 billion on Sept. 8 following its third-quarter results.

The information technology (.SPLRCT) and consumer discretionary stocks (.SPLRCD) were among the top S&P 500 sectoral losers, both down more than 1%.

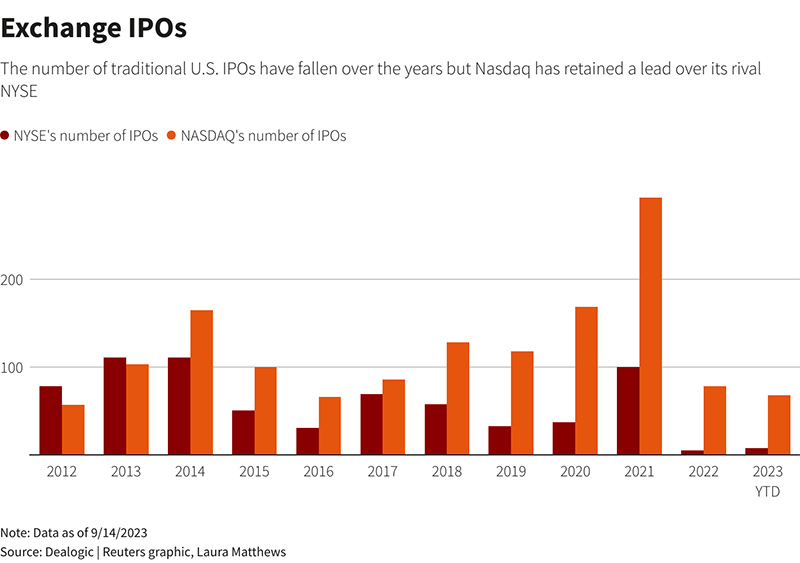

SoftBank’s Arm Holdings gained 2.4% after a stellar Nasdaq debut on Thursday, rekindling hopes of a turnaround in the initial public offering (IPO) market.

“The fact that the performance was good suggests the potential for more new issues, which is probably good for both the market and for the banking sector,” said Rick Meckler, partner at Cherry Lane Investments.

Arm’s strong debut prompted grocery delivery app Instacart to raise the proposed price range for its IPO to target a fully diluted valuation of up to $10 billion.

SoftBank’s Arm Holdings gained 2.4% after a stellar Nasdaq debut on Thursday, rekindling hopes of a turnaround in the initial public offering (IPO) market.

“The fact that the performance was good suggests the potential for more new issues, which is probably good for both the market and for the banking sector,” said Rick Meckler, partner at Cherry Lane Investments.

Arm’s strong debut prompted grocery delivery app Instacart to raise the proposed price range for its IPO to target a fully diluted valuation of up to $10 billion.

Investors are also focused on Neumora Therapeutics’ (NMRA.O) debut later in the day after the SoftBank-backed firm raised $250 mln in its U.S. IPO.

Easing worries about a recession without and optimism over an interest-rate pause next week had pushed U.S. stocks higher on Thursday.

Traders’ bets on the Federal Reserve holding rates steady in its Sept. 20 policy meeting remained intact at 97%, while their odds for a pause in November stood at nearly 68%, according to the CME FedWatch Tool.

“The general market view is that if we’re not at the top of the rate prices, we’re extremely close (to the end of rate-hikes) and small deviations in CPI or PPI probably won’t change that,” Meckler added.

The expiry of quarterly derivatives contracts tied to stocks, index options and futures, also known as “triple witching”, later in the day is expected to keep markets volatile.

At 10:06 a.m. ET, the Dow Jones Industrial Average (.DJI) was down 29.31 points, or 0.08%, at 34,877.80, the S&P 500 (.SPX) was down 19.65 points, or 0.44%, at 4,485.45, and the Nasdaq Composite (.IXIC) was down 119.74 points, or 0.86%, at 13,806.32.

Automakers Ford Motor (F.N) and General Motors (GM.N) erased premarket losses to rise 0.9% and 1.8%, respectively.

The United Auto Workers union launched simultaneous strikes at three factories owned by the “Detroit Three”, including Chrysler-owner Stellantis (STLAM.MI), marking the most ambitious U.S. industrial labor action in decades.

Declining issues outnumbered advancers by a 1.36-to-1 ratio on the NYSE and by a 1.46-to-1 ratio on the Nasdaq.

The S&P index recorded six new 52-week highs and five new lows, while the Nasdaq recorded 23 new highs and 75 new lows.