U.S. stocks sank Friday morning after the crucial jobs report came in warmer than expected and jitters over troubles at Silicon Valley Bank (SIVB) continued to weigh on markets.

The S&P 500 (^GSPC) declined by 0.9%, while the Dow Jones Industrial Average (^DJI) edged down 0.5%. Contracts with the technology-heavy Nasdaq Composite (^IXIC) plunged 1.3% Friday morning.

Bond yields fell. The yield on the benchmark 10-year U.S. Treasury note down to 3.7% Friday morning.

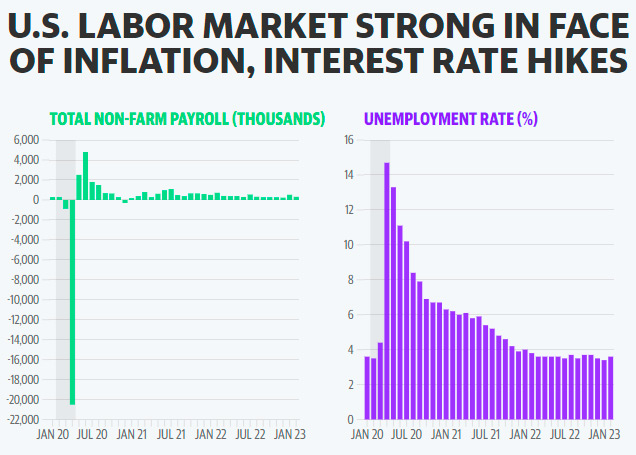

Friday’s February jobs print blew past expectations once again, as the U.S. economy added 311,000 jobs, a slower pace from the January’s blowout number, and compared to consensus estimates from economists for job gains of 225,000. The unemployment rate edged up to 3.6%, and wage growth rose 4.6% on a yearly basis, slower than expected.

“Just go to first principles. The labor markets are undeniably strong. Over the last three months, nonfarm payrolls have averaged 351,000,” Neil Dutta, Head of Economics at Renaissance Macro Research, wrote in a statement.

“Full-time employment has surged by an average of 442,000 per month this year. Given the participation rate increase and slowing in wage growth (mostly a composition story) I can see why the soft-landing bulls are running with today’s report, especially given the set up going in, but let’s state the obvious, the Fed’s work is not done. Terminal rates are still going up. Oh, and it is time to hit the mute button on people talking about weather, imminent recession, and calling the no-landing story a hoax,” he added.

Notable job gains were in leisure and hospitality, retail trade, government, and health care, while employment lagged in information, transportation and warehousing, the Bureau of Labor Statistics reported.

The Federal Reserve has been keeping a close eye on all fronts to the labor market as the central bank tries to cool down inflation. February’s job print continued to reveal the hot hiring streak, even as other recent government data points to the economy picking up steam. Economists were looking at the payrolls release as a report that would show whether the hiring gain was an outlier or the start of economic acceleration.

The accumulation of economic data, coupled with comments this week from Chair Jerome Powell, has sparked the debate on whether a 0.25% or 0.50% rate hike from the Fed is likely for its March meeting.

According to the CME FedWatch tool, market participants are betting the Federal Reserve will move a quarter-point rate hike at its next meeting.

However, recent events in the banking world have spurred other concerns for Fed officials as their monetary tightening policy induces stresses into the banking system.

A major tech firm lender revealed it’s in deep trouble. Silicon Valley Bank’s (SIVB) share price tanked 68% during Friday’s premarket trading session after announcing it needs to raise $2.25 billion to offset a $1.8 billion loss on some bond sales.

On Friday morning, the stock was halted amid extended collapse, sparking worry for the banking sector. The turmoil continued as CNBC reported that SVB Financial, parent of Silicon Valley Bank, is having discussions about selling itself as the lender fails its attempts to raise capital.

The sour sentiment has spread across markets as the KBW Bank index (^BKX) fell over 3%, while index members including Bank of America (BAC), JPMorgan Chase (JPM) moved down Friday morning. Shares of First Republic Bank (FRC) plummeted 51% and the stock has been halted due to volatility.

In single stock moves, Allbirds (BIRD) shares plunged 22% after the footwear retailer posted disappointing quarterly earnings report that included a double-digit drop in sales, and revealed a $101 million annual loss.

Elsewhere, in the cryptocurrency market, Bitcoin (BTC) crumbled below $20,000 Friday amid liquidation of Silvergate Capital (SI) and regulatory pressures on the industry.