Investors digested a rush of economic data on Thursday which showed the economy continues to perform better than feared, particularly when it comes to consumer spending.

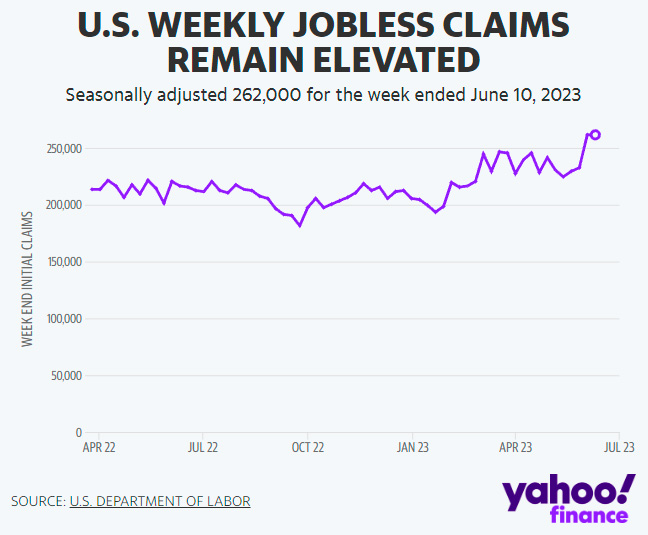

Thursday’s rush of news comes just a day after the Federal Reserve paused its aggressive rate hikes but signaled two more increases would be needed this year. The weekly report on initial jobless claims showed some softening in the labor market, while retail sales beat expectations and manufacturing activity showed signs of resilience.

“There was a little for everyone, but more signs of strength than weakness,” strategists at Bespoke Investment Group wrote in a note early Thursday following the news.

On the labor market side, jobless claims climbed higher than expected last week, a sign of a softening labor market. The number of Americans filing new claims for unemployment benefits reached 262,000, the highest level since October 2021 and higher than the 245,000 consensus estimated by economists.

Meanwhile retail sales, which are not adjusted for inflation, advanced by 0.3% month over month, versus estimates for a decline of 0.2%. Retail sales for May grew 1.6% year-over-year.

The print comes on the heels of the latest consumer price index which showed inflation cooling to 4% in May compared to the same month last year. Oren Klachkin, lead US economist at Oxford Economics, wrote in a note Thursday this report showed, “the recession will be delayed as long as consumers continue to spend.”

On the manufacturing side, New York state factory activity data released Thursday showed a surprise rebound in orders and shipments in June. The Federal Reserve Bank of New York’s general business conditions index expanded the most in three years to 6.6. The reading surpassed most economists’ forecasts.

Meanwhile a survey among manufacturers in the Philadelphia region showed manufacturing activity contracted in June for a 10th consecutive negative reading. However, “the index for shipments rose and turned positive. The employment index suggests steady employment overall,” said the Manufacturing Business Outlook Survey.

On Wednesday, the Federal Reserve announced it would not raise interest rates for now, but signaled another two hikes could be in store later this year as it aims to cool inflation.

At issue for the Fed has been the continued strength in the US labor market, with jobs reports in both April and May far exceeding estimates.

Thursday’s jobless claims data, however, indicates the number of Americans seeking unemployment benefits is ticking higher amid layoff announcements.

“If you want to think about the labor market, that’s always the last shoe to fall. Once the labor market breaks, that’s when you’re in the recession,” JP Morgan Asset Management global market strategist Jordan Jackson told Yahoo Finance Live on Wednesday after the Fed decision. “We’re seeing signs that the labor market will start to come under pressure.

“I think the Fed should be done. I think further hikes, especially two more hikes potentially is overdoing it,” added Jackson.