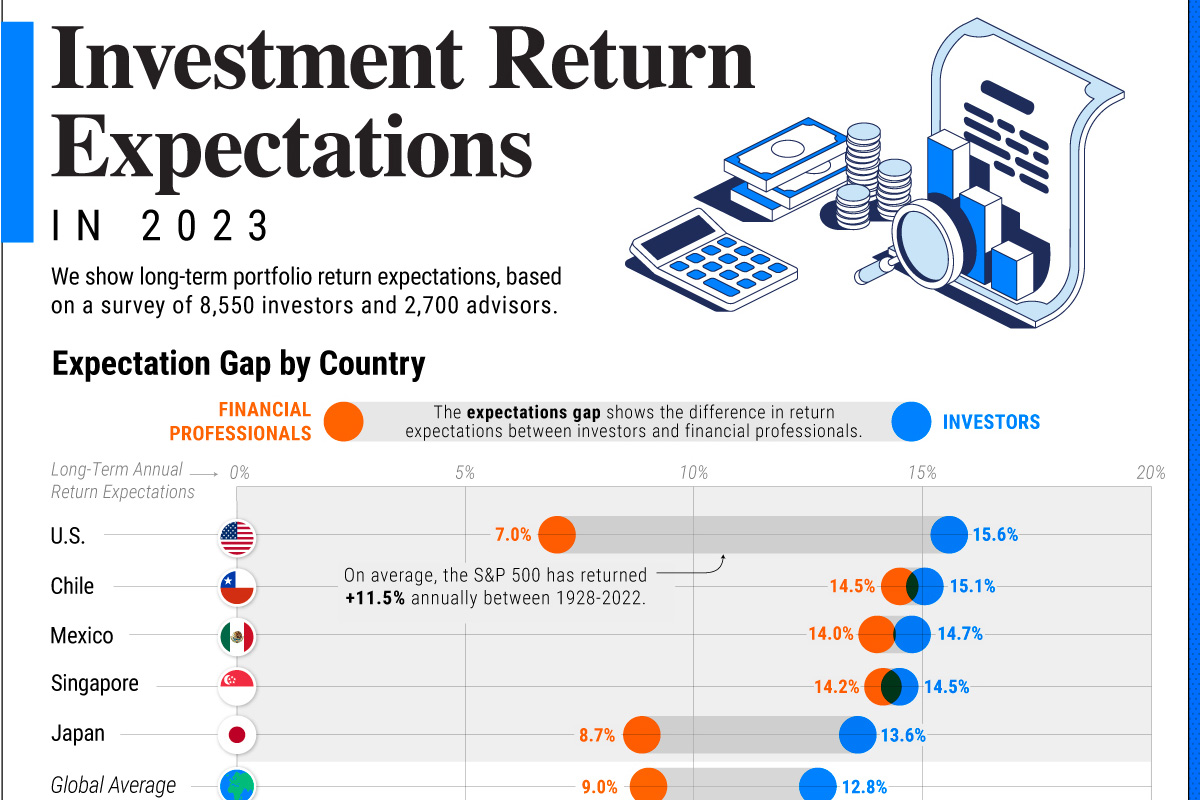

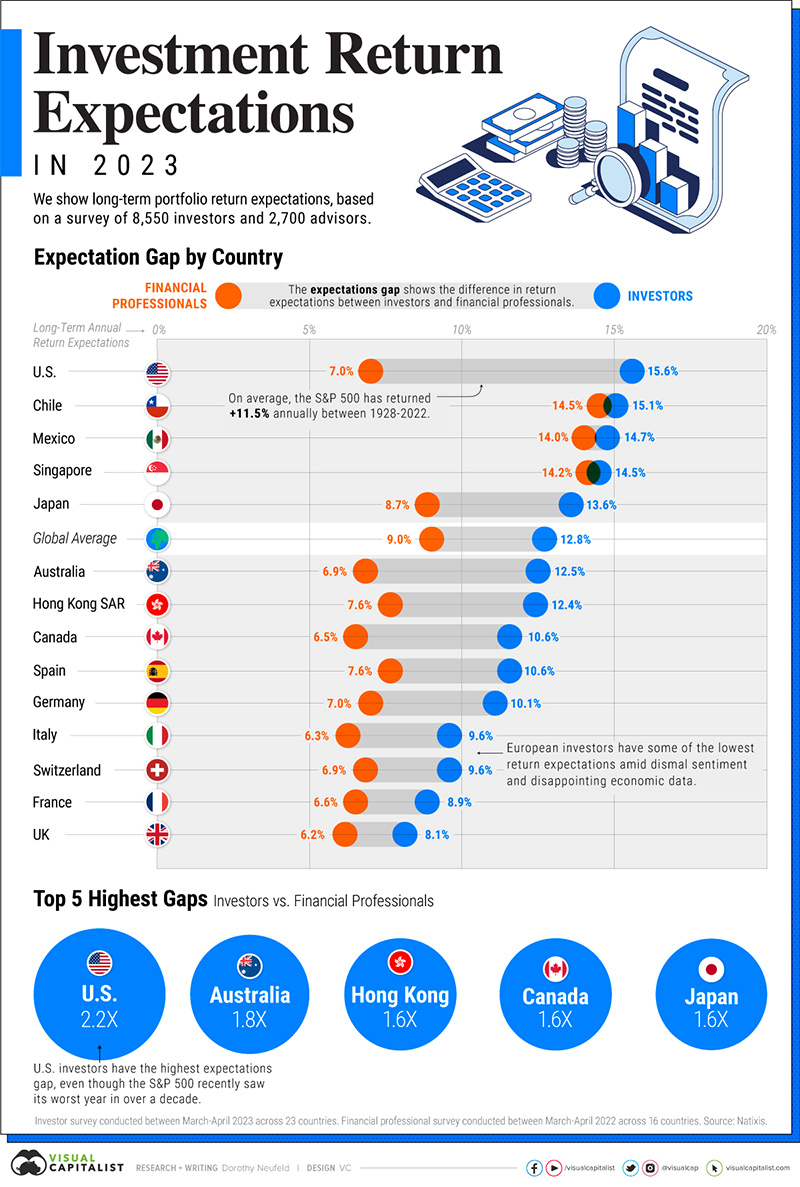

Visualizing Portfolio Return Expectations, by Country

How do investors’ return expectations differ from those of advisors? How does this expectation gap shift across countries?

Despite 2022 being the worst year for stock markets in over a decade, investors around the world appear confident about the long-term performance of their portfolios. These convictions point towards resilience across global economies, driven by strong labor markets and moderating inflation.

While advisors are optimistic, their expectations are more conservative overall.

This graphic shows the return expectation gap by country between investors and financial professionals in 2023, based on data from Natixis.

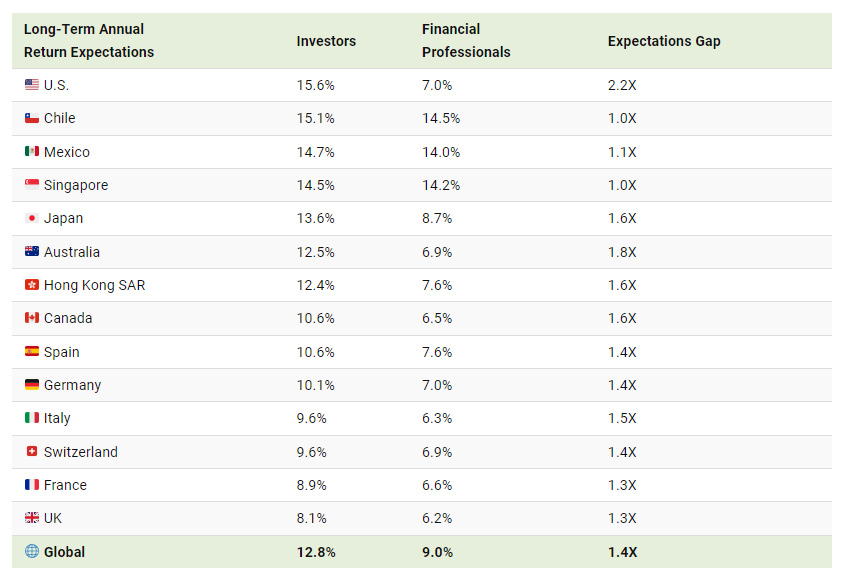

Expectation Gap by Country

Below, we show the return expectation gap by country, based on a survey of 8,550 investors and 2,700 financial professionals:

Investors in the U.S. have the highest long-term annual return expectations, at 15.6%. The U.S. also has the highest expectations gap across countries, with investors’ expectations more than double that of advisors.

Likely influencing investor convictions are the outsized returns seen in the last decade, led by big tech. This year is no exception, as a handful of tech giants are seeing soaring returns, lifting the overall market.

From a broader perspective, the S&P 500 has returned 11.5% on average annually since 1928.

Following next in line were investors in Chile and Mexico with return expectations of 15.1% and 14.7%, respectively. Unlike many global markets, the MSCI Chile Index posted double-digit returns in 2022.

Global financial hub, Singapore, has the lowest expectations gap across countries.

Investors in the UK and Europe, have the most moderate return expectations overall. Confidence has been weighed down by geopolitical tensions, high interest rates, and dismal economic data.

Return Expectations Across Asset Classes

What are the expected returns for different asset classes over the next decade?

A separate report by Vanguard used a quantitative model to forecast returns through to 2033. For U.S. equities, it projects 4.1-6.1% in annualized returns. Global equities are forecast to have 6.4-8.4% returns, outperforming U.S. stocks over the next decade.

Bonds, meanwhile, are forecast to see 3.6-4.6% annualized returns for the U.S. aggregate market, while U.S. Treasuries are projected to average 3.3-4.3% annually.

While it’s impossible to predict the future, we can see a clear expectation gap not only between countries, but between advisors, clients, and other models. Factors such as inflation, interest rates, and the ability for countries to weather economic headwinds will likely have a significant influence on future portfolio returns.