The Dow Jones Industrial Average briefly dropped more than 250 points Friday after key economic data, with the major stock indexes eyeing a losing week as investors brace for future rate hikes from the Federal Reserve. Tesla stock was downgraded to sell at DZ Bank.

On the economic front, S&P Global’s preliminary June Purchasing Managers’ Index (PMI) for the manufacturing and services indexes came out Friday morning. The manufacturing index fell to 46.3, below estimates for a 48.5 reading. The services index eased to 54.1, above estimates for a 53.5 reading.

This week, Fed Chair Jerome Powell set the stage for higher interest rates in the coming months. On Wednesday, Powell reiterated that more interest rate increases are likely needed to bring down inflation, saying “Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.”

Investors now see a more-than-74% chance of a quarter-point hike at the Fed’s July meeting, per CME FedWatch Tool. That’s up from 67% one week ago.

CarMax (KMX) raced 7% higher Friday after the company reported better-than-expected Q1 earnings and sales results.

EV giant Tesla (TSLA) dropped more than 4% Friday. Dow Jones tech giants Apple (AAPL) and Microsoft (MSFT) were lower after today’s stock market open.

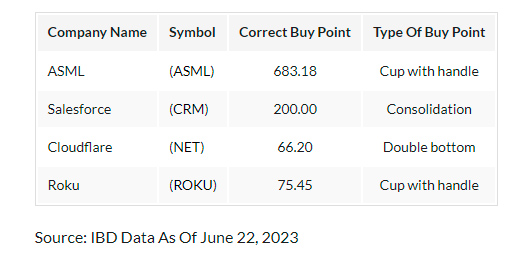

Chipotle Mexican Grill (CMG), McKesson (MCK), MongoDB (MDB) and Roku (ROKU) — as well as Dow Jones stocks JPMorgan Chase (JPM) and Salesforce (CRM) — are among the best stocks to buy or watch in the ongoing stock market pullback.

Tesla is an IBD Leaderboard stock. McKesson is an IBD SwingTrader stock, while Chipotle featured as Wednesday’s Stock Of The Day as well as in this week’s Stocks Near A Buy Zone column.

Dow Jones Today: Oil Prices, Treasury Yields

After Friday’s opening bell, the Dow Jones Industrial Average fell 0.5%, while the S&P 500 lost 0.7%. And the tech-heavy Nasdaq composite dropped 1% in morning action.

Among U.S. exchange-traded funds, the Nasdaq 100 tracker Invesco QQQ Trust (QQQ) traded down 1%, while the SPDR S&P 500 ETF (SPY) moved down 0.8% early Friday.

On Friday, the 10-year U.S. Treasury yield ticked lower to 3.69%. The yield has recently been bobbing in a range between 3.57% and 3.85%, settling higher Thursday at 3.79%.

Oil prices continued to back off Friday morning. West Texas Intermediate futures fell nearly 3%, to below $68 a barrel.

Stock Market Action

On Thursday, The Dow Jones Industrial Average cut back its early losses to close essentially flat. In the Dow 30, Boeing (BA) triggered the 7% loss rule from a 221.33 buy point. BA stock fell more than 3% to extend a losing streak to three sessions.

Market performance varied by index. The S&P 500 climbed 0.4%, and the Nasdaq composite advanced nearly 1%. But the small-cap Russell 2000 moved down 0.8%.

Thursday’s Big Picture column cautioned, “Despite the stock market pullback, IBD’s recommended market exposure still sits at 60%-80%. So far, the market pullback is normal, but keep an eye out for more signs of institutional selling. If distribution days start to pile up, then it would be prudent to methodically reduce exposure.”

Now is an important time to read IBD’s The Big Picture column amid the ongoing stock market uptrend.

Dow Jones Stocks To Buy And Watch: JPMorgan, Salesforce

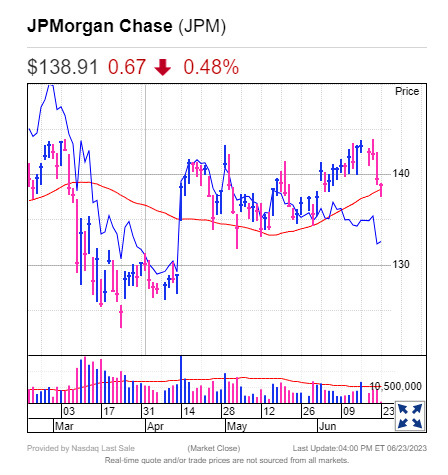

Dow Jones banking leader JPMorgan is just below a 143.37 flat-base buy point after Thursday’s 1.9% drop. JPM stock fell 0.9% early Friday.

Salesforce managed to steady itself after slumping following earnings. It is now testing support at the 21-day exponential moving average. The megacap tech previously moved past a pair of new alternative entries at 194.01 and at 200.10, according to IBD Leaderboard analysis.

In recent weeks, shares reached the 20% profit zone from a 178.94 cup-with-handle entry, and are now trying to bounce from support at the 10-week line. CRM stock dropped 1.6% Friday morning.

Best Stocks To Buy And Watch: Chipotle, McKesson, MongoDB, Roku

IBD Leaderboard watchlist stock Chipotle is rebounding from its 10-week line and approaching a flat base’s 2,139.88 buy point, according to IBD MarketSmith pattern recognition. Chipotle was Wednesday’s IBD Stock Of The Day. CMG stock fell 0.6% Friday morning.

IBD SwingTrader stock McKesson is in buy range past a 401.53 cup-with-handle entry. The 5% buy zone goes up to 421.61. Shares were up 0.3% Friday.

MongoDB is trading tightly after its recent earnings-fueled gap up, offering a new entry. The three-weeks-tight formation shows a buy point at 398.89, while aggressive investors could use a trendline-entry around 386. MDB stock lost 1.7% Friday morning.

Streaming giant Roku is building a cup-with-handle base with a 75.45 buy point, according to IBD MarketSmith pattern recognition, even as the stock extended a losing streak to six sessions Thursday. Roku stock fell 0.8% early Friday.

Best Stocks To Buy And Watch In Stock Market Rally

These are four best stocks to buy and watch in today’s stock market, including a Dow Jones leader.

Tesla Stock

IBD Leaderboard stock Tesla rose 2% Thursday despite a Morgan Stanley downgrade, reversing higher after early losses. Shares remains sharply extended above a double-bottom base’s 207.79 buy point. They closed Thursday 16% off their 52-week high.

TSLA stock threatened to give up all of Thursday’s gains, falling 4.1% Friday. Early Friday, DZ Bank double-downgraded the stock from buy to sell, skipping the hold rating.

Among Dow Jones stocks, Apple stock hit an all-time highs Thursday, moving 1.65% higher in the session. On Thursday, shares traded as high as 187.04. The stock continues to hold sharply above a 157.38 buy point. Early Friday, AAPL stock was down 0.7%.

Microsoft shares rebounded 1.8% Thursday, snapping a three-day losing streak. Last week, the stock hit a record high at 351.47. Despite the recent losses, MSFT stock remains in the 20%-25% profit-taking zone from a 276.76 flat-base buy point, so investors take at least some profits. And on Friday morning, Microsoft shares were off 1.5%.